This Made Me Laugh: Insurers Do Not Owe A Fiduciary Duty To Everyone

ALI Restatement Webinar: Thank You -- And Have The Webinar Put On For Your Company

Appeals Court Throws A Cold One On Liquor Liability Exclusion [Must Read If You Deal With This]

Winner Of The First Insurance Coverage Epitaph Contest

Ending Tomorrow: Insurance Key Issues 25% Off Sale

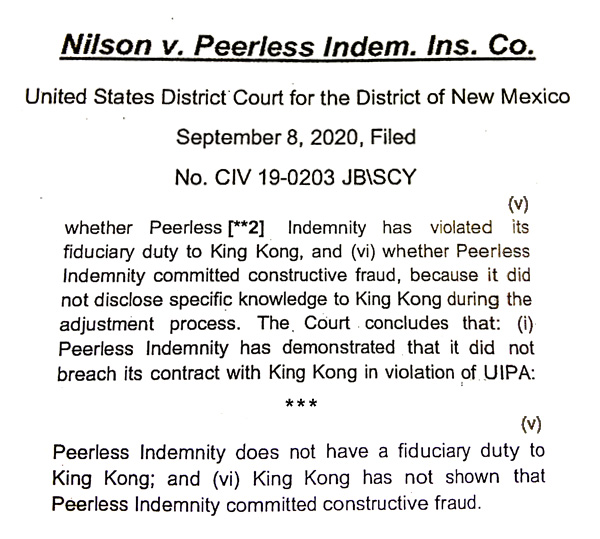

This Made Me Laugh: Insurers Do Not Owe A Fiduciary Duty To Everyone

I was going through some Coverage Opinions material and I completely forgot about this case from last year that I meant to use. Every time I read this I laugh. It turns out that insurers do not owe a fiduciary duty to everyone.

ALI Restatement Webinar:

Thank You -- And Have The Webinar Put On For Your Company

Thank you to everyone who attended the webinar on Monday: ALI Restatement of the Law - Liability Insurance: Lessons Learned After Three Years.

When the curtain went, over 700 people had registered for the RLLI webinar. Representatives of dozens of insurers were in attendance, as well as numerous outside counsel on both the insurer and policyholder side.

The goal was simple, as I said on the first slide: "Present an objective, evidence-based examination of the impact of courts' use of the RLLI in decisions: (1) to date and (2) going forward"

This was not another Hatfield and McCoy-like rehashing of the RLLI feud and whether policyholders are advantaged by it and insurers are treated unfairly. While I discussed that, I did so based on the evidence provided by courts over the past 3+ years since the RLLI was approved. I also discussed coverage issues that may be affected by the RLLI going forward. Based on the feedback from attendees, a discussion of the RLLI — using an objective over advocacy approach -- was appreciated. People came away with a more realistic understanding of the possible role of the RLLI.

Let me know if you'd like me to put on the ALI Insurance Restatement webinar for your insurer claims department. It's free and has been approved for an hour of CLE in CT, PA, NY, NJ, DE and IL and Continuing Education (CE) in TX, FL, OK, DE. It takes just minutes to organize. We'll pick a date, I'll send a Zoom link to someone on your end, who then sends it the attendees, and that's it. Voila.

Other free, insurer claims department webinars available:

· 50 Item ROR Checklist

· Advanced Issues: Road Trip Through The CGL Policy

· Top 10 Duty to Defend Issues

I have lost track of how many insurer webinars I've done this year. There have been as many as 3 in one week. But they are so easy and I've enjoyed them immensely. So no reason to stop doing them.

Drop me a note if you are interested.

Appeals Court Throws A Cold One On Liquor Liability Exclusion [Must Read If You Deal With This]

The Indiana Court of Appeals's recent decision in Ebert v. Illinois Casualty Company, No. 21A-PL-69 (Ind. Ct. App. Aug. 30, 2021) demonstrates a real potential shortcoming in ISO's Liquor Liability exclusion in its commercial general liability policy. And, to be clear, I'm referring to the 2013 version of the Liquor Liability exclusion, which was amended to be broadened in scope.

At issue in Ebert was coverage arising out of the following scenario: "On July 5, 2015, William Spence consumed alcohol at Big Daddy's and was visibly intoxicated. After Spence became involved in an altercation, an employee of Little Daddy's [a related bar], who happened to be helping out at Big Daddy's as a bouncer, removed Spence from the premises. In the parking lot, the bouncer insisted that Spence leave and threatened violence if Spence did not leave. Spence got into his truck and drove away. Shortly thereafter, he struck a car occupied by the Ebert family, causing significant injuries."

The court added a little more flavor to the incident. After being removed from the premises, Spence wanted to go back in and get his hat. The bouncer, Christopher French (a/k/a Razor), replied: "Dude, you know you've got to go past me to get in here. . . . You're not getting your damn hat, dude. You need to get in that damn truck and get the hell out of here 'cause you get any closer to me, I'm gonna stick that pipe up your a**." With that, Spence got in his truck and left.

Big Daddy's sought coverage, for the Ebert family's lawsuit, from Illinois Casualty Company under various polices, including commercial general liability. As you would expect, Illinois Casualty disclaimed coverage on the basis of the policy's Liquor Liability exclusion, which is virtually the same as the one contained in the 2013 version of the ISO CGL form [and which was amended to be broadened in scope]:

(c) This insurance does not apply to . . . "Bodily injury" or "property damage" for which any insured may be held liable by reason of:

(1) Causing or contributing to the intoxication of any person;

(2) The furnishing of alcoholic beverages to a person under the legal drinking age or under the influence of alcohol; or

(3) Any statute, ordinance or regulation relating to the sale, gift, distribution or use of alcoholic beverages.

This exclusion - c.(l), c.(2), and c.(3), applies even if the claims allege negligence or other wrongdoing in:

(a) The supervision, hiring, employment, training, or monitoring of others by an insured; or

(b) Providing or failing to provide transportation with respect to any person that may be under the influence of alcohol;

[i]f the "occurrence" which caused the "bodily injury" or "property damage" involved that which is described in Paragraph (1), (2), or (3) above.

Examining the exclusion, the court had no problem concluding that it precluded coverage for "the claims relating to causing or contributing to intoxication, including claims relating to the failure to provide alternative transportation, [as these] clearly do rely on allegations that place them within the coverage exclusion."

[Broadening of the Liquor Liability exclusion, to include "providing or failing to provide transportation with respect to any person that may be under the influence of alcohol" was added to the 2013 version.]

However, the court also concluded – at least for purposes of duty to defend -- that the Liquor Liability exclusion did not preclude coverage for "any claims that could potentially prevail independently of whether defendants furnished Spence with alcohol."

On that point, the court explained: "Without commenting on the validity of the claims, or their likelihood of success on their merits, we find that the negligence theory based on allowing Spence to leave the premises despite knowledge of his intoxication, for example, does not require proof that the bars 'caused or contributed' to said intoxication. As such, this is not a claim for which the business owner's policy excludes coverage, and, thus, the duty to defend attaches. In fact, Illinois Casualty admits that the exclusion only covers claims 'for which the insured is liable by reason of causing or contributing to the intoxication of any person, furnishing of alcoholic beverages to a person under the influence of alcohol, or violation of any statute, ordinance or regulation relating to the sale, distribution or use of alcoholic beverages.'"

In essence, the court's decision came down to this: [S]ome of the Eberts' claims rely on Spence's impairment independently of whether the bars served alcohol to him. Liability could attach under the failure to intervene theories if Spence had arrived already intoxicated, and not been served. Indeed, liability could attach under those theories even if Spence's impairment had resulted from something other than alcohol, such as an epileptic seizure, the throes of delusion, or a diabetic incident."

The court's conclusion was simple: "If Illinois Casualty wished to exclude coverage for any and all claims arising from intoxication generally or from intoxicated patrons, then it would have drafted a contract that said so."

My take-away: This is not to say that the Liquor Liability exclusion is not broad enough to exclude coverage for any and all claims arising from intoxication generally or from intoxicated patrons. However, the Ebert court provides plaintiffs' counsel with a roadmap to potentially plead around it, at least for purposes of a duty to defend: alleging that impairment arose independently of whether alcohol was served.

Winner Of The First Insurance Coverage Epitaph Contest

The inaugural Insurance Coverage Epitaph contest is now in the books. It was simple. Send in something that a person would put on their tombstone to let people know that they spent a lifetime in the insurance coverage world. The contest was really popular. I was thrilled. You never know how a new contest is going to be received.

Congratulations to the winner: Lisa Mickley of Hall & Evans in Denver.

Lisa's entry is set out above in the photo. I chose it for its simplicity, because it gets to the heart of a CGL policy and leaves no doubt that the departed spent a lifetime in the world of coverage.

I'll send Lisa a copy of the 5th edition of Insurance Key Issues.

Thank you to all who entered. If I did not respond to your entry, please do not hold it against me. I am not a jerk. I swear. Sometimes all the reader mail for CO gets hard to keep up with.

I'm working on another idea for a contest.

|