|

|

|

|

|

| |

|

Vol. 10 - Issue 3

April 28, 2021

|

|

|

|

|

|

| |

Carolyn Cox spent 34 years as a commercial litigator in D.C. for Wilmer Cutler & Pickering, later known as the behemoth law firm WilmerHale. After retiring, she spent six years researching and writing a book that I couldn’t put down: The Snatch Racket - The Kidnapping Epidemic That Terrorized 1930s America. [The WSJ gave it a well-deserved phenomenal review.]

I had the pleasure of interviewing Carolyn, for the ABA Journal website, about her new book. It may be non-fiction, but is as gripping as any best-selling legal thriller.

I hope you’ll check out the interview here:

https://www.abajournal.com/columns/article/retired-biglaw-partner-tells-tales-of-lawyers-fbi-and-kidnapping-epidemic-of-the-1930s-in-new-book

|

|

|

|

Vol. 10 - Issue 3

April 28, 2021

Snoring And Insurance Coverage

|

|

|

|

|

| |

For Martha Wood, of Fort Dodge, Iowa, sleeping could be a very unpleasant experience. Her husband, Charlie, often snored. Or, as Charlie saw, allegedly snored. As far as Charlie was concerned, there was no proof that he snored. First, and most importantly, he had never heard himself snore.

Fed up with Charlie’s juvenile denial, Martha videotaped Charlie sleeping. Charlie’s response was that the video had been doctored. Sure, the noise coming from Charlie’s mouth, as he slept, was as loud as a freight train. But, as Charlie noted, the couple lived very close to train tracks. Charlie maintained that Martha could have easily taped the sound of a freight train going by and altered the video to appear that the noise was coming from from Charlie.

A year after Martha made the video, the couple divorced. Two years later, Charlie remarried. A week after the wedding, Martha posted on Facebook the video of Charlie snoring with the caption: “Charlie has a new wife. She must not have very good hearing.”

It didn’t take long for word about Martha’s post to reach Charlie. He did not take it well. Charlie sued Martha in District Court in Webster County, Iowa. He alleged that Martha had violated his right to privacy by posting the video on Facebook. [The video revealed Charlie’s body, under a blanket, and only his shoulders upward were exposed).

Martha sought coverage for the suit under her homeowner’s policy issued by Corn Stalk Property & Casualty Ins. Co. The policy provided coverage for “personal injury,” which it defined to include invasion of privacy. So, needless to say, Martha was quite surprised that Corn Stalk P&C denied coverage.

As Corn Stalk saw it, yes, the suit’s allegation of invasion of privacy satisfied the definition of “personal injury.” However, coverage was barred on the basis of the exclusion for “‘personal injury,’ to a resident of the household identified on the declarations page, arising out of activities in such household.”

Martha was outraged. She responded to the denial with the following tirade: “Charlie Wood was not a resident of the household at the time that the video was posted on Facebook. We were divorced and Charlie had not been a resident for nearly three years. When the video was posted, Charlie was a resident of Debbie Dingledorf’s household. Debbie must not mind sleeping next to a 747 at take-off, or living with someone who drinks out of the juice bottle, eats ice cream out of the carton, leaves cream of wheat in the bowl so it can become harder than concrete the next morning, does not break down the cereal box when putting it in the trashcan, resulting in half the can being filled, leaves a wet towel from the shower on the bed and believes that classical music is not real music because the songs have no words.”

Martha sued Corn Stalk for breach of contract. The court in Martha v. Corn Stalk P&C, No. 21-4587 (Iowa Dist. Ct. April 2, 2021 (Webster Cty.)) concluded that no coverage was owed. The court agreed that the “resident of the household” exclusion applied.

The court explained its reasoning: “While this court is sympathetic to plaintiff’s situation – and would have done the same thing – it does alter that plain conclusion that Mr. Wood was a resident of the household at the time that the video was taken. It was from this action that the invasion of privacy emanated. The exclusion makes it clear that coverage for “personal injury” is excluded if it arises out of activities in the household. The phrase “arising out of” is interpreted broadly to mean “but for” causation. Here, but for Mr. Wood being a resident of the household, he would not have been videotaped and there would not have been an invasion of privacy. The exclusion does not state that the invasion of privacy must be to a resident of the household at the time that he or she was a resident.”

With no coverage, Martha was forced to settle with Charlie. He agreed to drop the suit in exchange for the return of his Big Mouth Billy Bass.

|

| |

That’s my time. I’m Randy Spencer. Contact Randy Spencer at

Randy.Spencer@coverageopinions.info |

|

| |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vol. 10 - Issue 3

April 28, 2021

Encore: Randy Spencer’s Open Mic

The “Thank You Wave” And Insurance Coverage

|

|

|

|

|

| |

I’ve never been to Indiana. I’m sure that the folks there are awfully courteous – especially in a small town. And that was definitely a factor in the court’s decision in this coverage case. But even so, it is still inexplicable.

The Indiana trial court’s decision in Hamilton v. Bloomington Property & Casualty Insurance Company, Circuit Court of Indiana, Jasper County, No. 14-104 (Sept. 23, 2014) started out like this. David Woodhall approached a four-way stop intersection. At virtually the same time Chris Hamilton approached the intersection. It was either a tie who got there first or, according to Hamilton, maybe it was him by a split second. Hamilton gave Woodhall a hand signal for him to proceed first. Woodhall crossed the intersection. But he failed to give Hamilton a thank you wave as he did. Hamilton became incensed by what he viewed as a very serious breach of driver courtesy.

Hamilton then proceeded to follow Woodhall. After about two miles, Woodhall pulled into the parking lot of a Circle K convenience store and went inside. Hamilton followed Woodhall in and approached him. Hamilton, in an angry voice, told Woodhall that he failed to give him a thank you wave when Hamilton let him proceed first at the intersection of Main and East 7th. Before Woodhall could say anything, Hamilton pushed him hard in the chest. Woodhall fell backwards into a potato chip display stand and suffered a broken elbow.

Woodhall sued Hamilton for the injuries sustained. Hamilton sought coverage from his homeowner’s insurer--Bloomington Property & Casualty Insurance Company. Not surprisingly, Bloomington disclaimed coverage, citing the policy’s exclusion for injuries that are expected or intended from the standpoint of the insured. Hamilton was forced to defend himself in the litigation. For various procedural reasons, Woodhall’s complaint was dismissed – but not before Hamilton incurred $14,000 in defense costs.

Hamilton filed a declaratory judgment action against Bloomington, alleging that it breached its duty to defend, and seeking payment of his defense costs. Each party filed a motion for summary judgment.

The trial court held that Bloomington breached its duty to defend. It looked to the Indiana Supreme Court’s decision in Freidline v. Shelby Ins. Co., 774 N.E.2d 37 (Ind. 2002) that the duty to defend is not determined solely by the allegations in the complaint. Therefore, the court held that Bloomington breached its duty to defend by not considering that, when Hamilton pushed Woodhall, Hamilton was still operating under the rage of having been denied a thank you wave. Therefore, the court held that a duty to defend existed because of the possibility that the self-defense exception, to the expected or intended exclusion, applied. The court looked to the Indiana Court of Appeals’s recent statement in Key v. Hamilton, 963 N.E.2d 573, 591 (Ind. Ct. App. 2012) (no relation) (Mathias, J., dissenting) and was clearly influenced by it: “Hoosiers can be rightfully proud that the courtesy of yielding to other drivers is still rather commonplace in Indiana.”

Based on this pronouncement in Key, the court held: “When a Hoosier driver is deprived a thank you wave, therefore being the victim of an egregious breach of driver etiquette, the standard in Freidline entitles him to a determination whether, under the circumstances, his subsequent push of the offending driver was tantamount to self-defense against what was the equivalent of an assault to the disrespected driver’s sensibilities.” (emphasis in original).

|

That’s my time. I’m Randy Spencer. Contact Randy Spencer at

Randy.Spencer@coverageopinions.info |

|

| |

|

| |

|

|

|

|

Vol. 10 - Issue 3

April 28, 2021

New Coverage Opinions Column: Leading Coverage Lawyers Share “If I Knew Then What I Know Now”

|

|

|

| |

Now and then I start a new column in Coverage Opinions. This is one of those nows and thens.

Sometimes I find myself thinking about things that I did as a coverage lawyer early-on in my career. And, when having such thoughts, I often wonder what I would have done differently in the situation if I knew then what I know now.

I’m sure others have such thoughts. So I decided that this called for a new column in Coverage Opinions. I would reach out to some of the nation’s leading coverage lawyers and ask them to share with readers lessons that they have learned over the years.

In essence, the column is designed to give younger lawyers the benefit of wisdom -- without their need to spend decades figuring it out for themselves.

For the inaugural column, I asked Ron Schiller and Dan Layden, shareholders at Philadelphia’s Hangley Aronchick Segal Pudlin & Schiller, to be the first to take the plunge. They graciously agreed. Ron and Dan have extensive experience representing insurers in some of the most complex and high-profile coverage cases is America. When I read a significant D&O coverage decision, I’m not surprised to see Ron’s and Dan’s names on it as counsel for an insurer. My surprise is when I don’t.

|

| |

|

Ron Schiller |

|

|

I have three lessons learned to share. Two of them are particularly insurance focused, while one is more geared to general litigation. I add a fourth lesson learned that is not so surprising but bears keeping in mind through the years and occasional hard times.

First, patience remains a virtue. Too many times, a case begins with a hostile court, a preliminary motion lost or even an important motion lost, just to result one or three years later in a major turnaround. Staying on target, keeping focused, and never letting the interim upset sidetrack you or the client are much more important than I anticipated 30 years ago. Few things are as rewarding professionally as sharing a win with the client who stuck with you until the jury, judge, arbitrator or appeals court hands you a win after a past setback. |

|

|

Second, effective advocacy on highly technical disputes means talking to the judge, jury, panel or appeals court like you would break down the case in a conversation with a smart friend. This is much more important than I realized initially. Judges are not persuaded by brilliance they don’t have the time or patience to understand. They like to reach the right conclusion with a smart, practical argument they can get the first time.

Third, a successful practice comes as much from strong client relationships as it does from your win-loss record. For the most part, after years of hard work, you truly are not measured solely by whether you won the last motion or case. Keep this in mind.

Fourth, through it all, having wonderful colleagues who have your back is critical. |

| |

|

Dan Layden |

|

|

First, consistency matters. So much development as a young lawyer is learning how to be an advocate. In my first years of practice, that often translated into trying to find answers that I thought our client wanted for thorny coverage issues. I learned over time that what insurer clients really want is consistency on issues that they can apply over time. Whether that's how to identify "related claims" or a common "occurrence", what constitutes "abuse," or how to allocate coverage, insurance companies want to know how to apply their contracts fairly to the facts of any individual claim. Sometimes that results in a finding of coverage and sometimes the road takes you a place where coverage is not available.. But being consistent in your advice or advocacy helps insurers communicate and develop credibility with their clients – the insureds. |

|

|

Second, insurance coverage is not a niche practice – it's a booming industry. New product lines are constantly being developed and existing product lines evolving. There's opportunity for practitioners that stay on top of or ahead of the current and developing exposures – e.g., asbestos, Y2K, sexual abuse, opioids, COVID-19.

Third, know and anticipate your audience. While judges and juries are insurance consumers, don't assume they'll understand your client's insurance policy (or initially know the difference between a "duty to defend" and defense costs as part of "loss"). So whether you're drafting a brief or advising on a reservation of rights, keep in mind that people other than the insured might be called on to decide if a coverage position is correct. Speak in language they'll understand. |

| |

| |

| |

| |

| |

| |

| |

| |

|

|

|

|

Vol. 10 - Issue 3

April 28, 2021

My Wall Street Journal Article: Charles Ponzi Contributed More To The Law Than Just His Infamous Scheme

|

|

|

| |

In the wake of Bernie Madoff’s death earlier this month, I published an article in The Wall Street Journal that looks at Charles Ponzi’s life beyond simply his infamous scheme.

Ponzi also made contributions to the legal system – with two interesting cases going to the U.S. Supreme Court (and the court’s most unique justice writing both opinions).

I hope you’ll check it out.

https://www.coverageopinions.info/WSJBernieMadoff.pdf

|

| |

| |

| |

|

|

|

|

Vol. 10 - Issue 3

April 28, 2021

Coming Soon-ish: 5th Edition Of “Insurance Key Issues”

|

|

|

| |

I do not know the exact date, but we are pleased to announce that the 5th Edition of “General Liability Insurance Coverage: Key Issues In Every State” is coming this summer. Work is progressing nicely and, mercifully, we can see the light at the end of the tunnel. The new edition of “Insurance Key Issues” is going to be a monster -- with many, many hundreds of new cases that have come down since early 2017. That’s a long time and the number of new cases is significant.

We are really looking forward to bringing this updated edition of “Insurance Key Issues” to the book’s loyal readers – for whom we are very grateful.

I’ll keep you posted.

|

| |

| |

| |

|

|

|

|

Vol. 10 - Issue 3

April 28, 2021

Winner Of The Annual Coverage Opinions “Final Four” Contest

|

|

|

| |

Well, let’s just say not many went out on a limb with their predictions in the Annual Coverage Opinions “Final Four” Contest. Of the barrage of entries, 99% picked Gonzaga and Baylor to play in the championship game. Then, of those risk-averse folks, 99% chose Gonzaga to cut down the net.

So kudos to Cecil Suitt, Senior Claims Adjuster for BXS Insurance in Little Rock, for having the courage to choose Baylor to be the last team standing. Of the few who chose Baylor, Cecil came closest in the total points tie-breaker.

This wasn’t just a complete guess for Cecil. He told me that, having seen what Baylor did to his Arkansas Razorbacks, he knew that the Bears were “special.”

I will send Cecil an autographed copy of John Grisham’s newest book, Sooley, being released on April 27. Coincidentally, the book is about a college basketball player.

Thanks to all who entered. As always, the entries were fun to read. Some showed emotion in their picks, ala Dickie V. Some provided analysis with their picks, displaying a little Jay Bilas [who, by the way, is a lawyer, and I interviewed for CO several years back].

But my favorite entry, hands down, was the one that came in Monday morning, after the semi-finals had been played. You guessed it -- this person chose Baylor and Gonzaga to tip-off that night. He was even more sure than all the others.

|

| |

| |

| |

|

|

|

|

Vol. 10 - Issue 3

April 28, 2021

ISO And The CGL Policy Are Making Beautiful Music In Iceland [This Is Surreal]

|

|

|

| |

I was so very delighted that a Coverage Opinions reader alerted me to this gem.

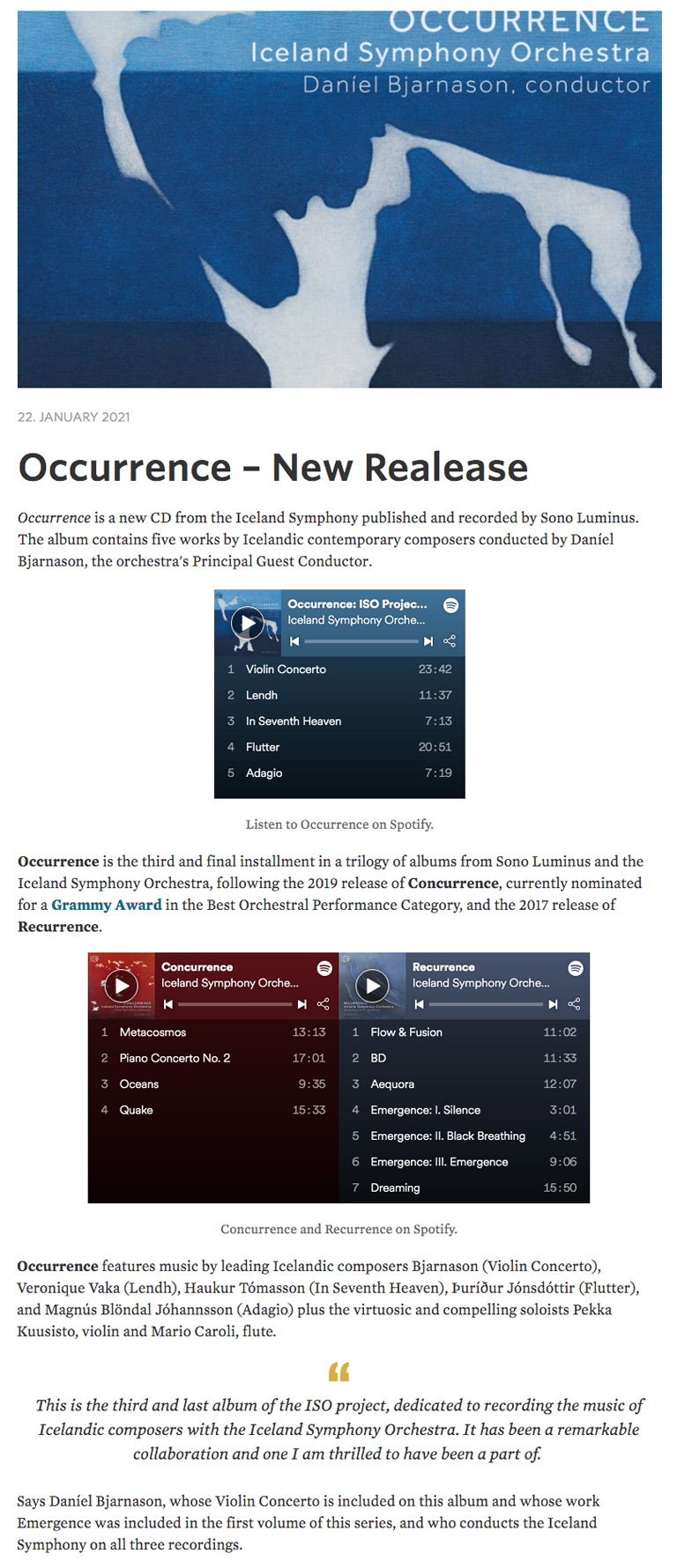

The Iceland Symphony Orchestra, which goes by the acronym ISO, recently released its latest CD, titled “Occurrence.”

I am not making this up. That’s because I couldn’t make it up.

[I am so grateful that CO readers send me these things.]

|

| |

|

| |

|

|

|

|

Vol. 10 - Issue 3

April 28, 2021

My Dog, Gracie, Owes Thanks To The Fourth Circuit Court Of Appeals

|

|

|

| |

|

| |

I took our dog, Gracie, for a walk not long ago and she insisted on talking along her Chewy Vuiton bag. I know, it’s super cute. But then, after five minutes, she drops it, and then dear old dad has to carry it the rest of the way.

Now, it you’re thinking that the fancy Louis Vuitton people are not amused by a dog toy, shaped like a pocketbook, that calls itself Chewy Vuiton, and contains a design that resembles Louis Vuitton’s iconic LV logo, you would be correctamundo. They made a federal case out of it. Literally. Louis Vuiton filed suit against Haute Diggity Dog, LLC, the manufacturer of the Chewy Vuiton toy. And I always though the French loved dogs.

This bruhaha all took place a while ago and it ended up with a Fourth Circuit opinion in Louis Vuitton Malletier, S.A. v. Haute Diggity Dog, LLC, 507 F.3d 252 (4th Cir. 2007).

Good news - Haute Diggity Dog won! Gracie can carry her Chewy Vuiton toy without fear of its seizure. Or worse, being arrested.

The Fourth Circuit opinion is long and, as you would expect, takes a deep dive into intellectual property/trademark law and the right to parody. I’ll set out a couple of paragraphs here, just to give you a sense of how the court saw it:

“In concluding that Haute Diggity Dog has a successful parody, we have impliedly concluded that Haute Diggity Dog appropriately mimicked a part of the LVM marks, but at the same time sufficiently distinguished its own product to communicate the satire. The differences are sufficiently obvious and the parody sufficiently blatant that a consumer encountering a ‘Chewy Vuiton’ dog toy would not mistake its source or sponsorship on the basis of mark similarity.”

“It is obvious that a ‘Chewy Vuiton’ plush imitation handbag, which does not open and is manufactured as a dog toy, is not a LOUIS VUITTON handbag sold by LVM. Even LVM’s most proximate products -- dog collars, leashes, and pet carriers -- are fashion accessories, not dog toys.”

Thanks to the Fourth Circuit, Gracie can stroll around the neighborhood in style. At least for five minutes.

|

| |

| |

| |

|

|

|

|

Vol. 10 - Issue 3

April 28, 2021

Insurance Coverage And The Unlucky Baseball Card Collector

|

|

|

| |

Tedd Wilson is an unlucky baseball card collector. We’re talking Red Sox/Bill Bucker unlucky. This is Cubs/Bartman folks.

Wilson, who considers himself one of the top experts in the baseball card world, lost some cards under the following circumstances:

“Mr. Wilson travels with his baseball cards. On March 29, 2018, Mr. Wilson flew from Huntsville, Alabama to Las Vegas, Nevada, landing between 8:00 p.m. and 8:30 p.m. When he arrived in Las Vegas, he hailed a cab. Mr. Wilson brought with him approximately 40 baseball cards, including approximately 30 insured cards, which he carried in a zipped canvas bag. He explained he brought the cards to Las Vegas with him, cards he values at over $150,000, because he is responsible for them, and leaving them at home would put his partner ‘under enormous stress.’”

Wilson had no luck with the cab company in locating his missing cards. He filed a police report with the Las Vegas police department and made a claim under a State Farm “Personal Articles Policy” that covered collectibles in the amount of $156,000 and change.

State Farm denied coverage “due to your [Mr. Wilson’s] repeated violations of the Conditions to coverage under the policy in the investigation of this claim.” State Farm also explained that Mr. Wilson “failed and refused to comply” with the policy, including making “numerous misrepresentations,” refusing to “answer questions related to the claim,” and “intentionally concealing relevant information.”

Litigation ensued. Following a lengthy opinion, the court in Wilson v. State Farm General Insurance Co., No. 20-324 (N.D. Ala. March 31, 2021) concluded that Mr. Wilson’s failure to comply with the policy’s post-loss requirements precluded coverage.

As for that bad luck, according to State Farm, “since 1998, Mr. Wilson has submitted at least five separate insurance claims ‘that are almost identical to the one he submitted’ in this litigation.”

The court also took judicial notice of other lawsuits in which Mr. Wilson has been involved regarding claims for lost baseball cards.

In April 2006, Mr. Wilson sued Vigilant Insurance Company in Florida state court. Mr. Wilson alleged that he lost approximately 46 baseball cards while in transit from his home in Fort Lauderdale to Las Vegas.

According to Vigilant, Mr. Wilson “failed to provide virtually any of the documentation requested by Vigilant to support his ownership of the baseball cards or to verify the circumstances surrounding the alleged loss or theft.” He also “failed to comply with the terms of the policy . . . by consistently and repeatedly refusing to answer relevant and material inquiries from Vigilant’s counsel at the Examination Under Oath. He “failed and refused to fully and truthfully answer relevant inquiries regarding his background, his employment history, his insurance history, his financial condition, the purchase history of the baseball card collection, his activities at the time of the loss, and the documentation and verification of his claim.”

In June 2013, United National Insurance Company sued Mr. Wilson in the United States District Court for the Southern District of Florida. Mr. Wilson had made a claim for an alleged burglary loss, resulting in the loss of collectible baseball cards. According to the court, “United’s investigation of Mr. Wilson’s claim revealed ‘at least two prior disputed insurance claims involving an alleged loss of collectibles, at least one of which was under circumstances substantially similar to the instant loss.’”

|

| |

| |

| |

|

|

|

|

Vol. 10 - Issue 3

April 28, 2021

I’ve Never Seen This Issue - Ever: Federal Appeals Court Addresses Constitutionality And The Duty To Defend

|

|

|

| |

If your favorite class in law school was Constitutional Law, and you chose to be a coverage lawyer, then you made the wrong choice. In the thousands upon thousands of coverage decisions that I have read over the years, I have never seen one where the court addressed an issue of constitutional law. But, as the adage goes, there is a first time for everything. The Ninth Circuit’s decision, in Adir Int’l v. Starr Indem. & Liab Co., No. 19-56320 (9th Cir. April 15, 2021), proves the old saying

The case starts out simple enough. Adir operates a retail chain called Curacao with stores in several western states. In 2017, the California Attorney General sued Adir and its Chief Executive Officer, for unfair and misleading business tactics that allegedly exploit Curacao’s mainly low-income, Spanish-speaking customer base. The complaint alleged violations of California's Unfair Competition Law (UCL) and False Advertising Law (FAL), and sought restitution, civil penalties, costs of suit, and other equitable relief.

Adair was insured by Starr. The insurer undertook the retailer’s defense under a reservation of rights and then became actively involved in it. But this all changed in March 2019 when Starr received a written warning, from the California Attorney General’s Office, that Starr violated California Insurance Code § 533.5, which provides, in part:

(b) No policy of insurance shall provide, or be construed to provide, any duty to defend, as defined in subdivision (c), any claim in any criminal action or proceeding or in any action or proceeding brought pursuant to [the UCL or FAL] in which the recovery of a fine, penalty, or restitution is sought by the Attorney General . . . notwithstanding whether the exclusion or exception regarding the duty to defend this type of claim is expressly stated in the policy.

(c) For the purpose of this section, “duty to defend” means the insurer's right or obligation to investigate, contest, defend, control the defense of, compromise, settle, negotiate the compromise or settlement of, or indemnify for the cost of any aspect of defending any claim in any criminal action or proceeding or in any action or proceeding brought pursuant to [the UCL or FAL] in which the insured expects or contends that (1) the insurer is liable or is potentially liable to make any payment on behalf of the insured or (2) the insurer will provide a defense for a claim even though the insurer is precluded by law from indemnifying that claim.

(d) Any provision in a policy of insurance which is in violation of subdivision (a) or (b) is contrary to public policy and void.

A few weeks after getting the letter, Starr stopped paying Adir’s defense costs.

Adir sued Starr. Putting aside what happened at the District Court – Starr won – the case went to the Ninth Circuit.

Adir argued that California Insurance Code § 533.5(b), “which bars insurance companies from paying legal defense fees for certain consumer protection lawsuits brought by the state, violates the Due Process Clauses of the Fifth and Fourteenth Amendments because it interferes with an insured’s ability to fund and retain the counsel of its choice. As Adir points out, California has stacked the deck against defendants facing these lawsuits filed by the state: Although the Attorney General has yet to prove any of the allegations in his lawsuit, he has invoked the power of the state to deny insurance coverage that Adir paid for to defend itself.”

But the federal appeals court did not see it this way.

Following a review of choice of counsel law generally, the court observed that “the due process right to retain counsel in civil cases appears to apply only in extreme scenarios where the government substantially interferes with a party’s ability to communicate with his or her lawyer or actively prevents a party who is willing and able to obtain counsel from doing so.” Essentially the court concluded that the right to counsel, in civil cases, is not what it is in criminal cases.

With this in mind, the court turned to whether Adir’s proposed right, “which really boils down to an indirect right to fund and retain the counsel through an insurance contract,” fits into the existing due process right that applies to the retention of counsel in civil cases.

The court answered that it did not:

“At the end of the day, California’s law only makes it harder, though not necessarily impossible, for a civil litigant to retain the counsel of their choice. Adir has not alleged that the government actively thwarted it from obtaining counsel, or that the law precluded it from communicating with counsel. Indeed, Adir appears to have obtained an able and competent counsel — without the use of insurance proceeds — for this appeal. We thus rule that California Insurance Code § 533.5(b) does not impinge on a due process right to retain counsel.”

|

| |

| |

| |

|

|

|

|

Vol. 10 - Issue 3

April 28, 2021

|

|

|

|

|

|

| |

I addressed this issue in the 2016 “Top 10 Coverage Cases of the Year” article in the context of the Illinois Court of Appeals decision in Skolnik v. Allied Property and Casualty Ins. Co., where I made the following observation:

“There are a host of exclusions that preclude coverage for injury arising out of some specified conduct on the part of an insured: assault and battery, furnishing alcohol, criminal acts, etc. These exclusions are often interpreted broadly on account of being expressed in ‘arising out of’ language. Skolnik demonstrates that a plaintiff may be able to trigger a defense obligation, in a case that would otherwise be subject to a broad ‘specified conduct exclusion,’ by simply alleging (provable or not) that, after the insured committed the excluded conduct, it failed to summon help for the victim. And such failure was also a cause of the plaintiff’s injuries.”

In Skolnik, the court held that, at least for purposes of the duty to defend purposes, the “controlled substances exclusion” did not apply. The court reached this conclusion despite an autopsy notation describing cause of death as methadone intoxication. As the court saw it, a genuine issue of material fact existed as to whether the death was caused solely by methadone ingestion or the insured’s failure to seek assistance for the insured following such ingestion.

This same issue arose not long ago in Admiral Ins. Co. v. Anderson, No. 19C3468 (N.D. Ill. March 29, 2021). At issue was coverage, for two members of a sorority, under a policy issued to the sorority, for claims that, as a consequence of various acts of hazing of a sorority pledge, she committed suicide.

Specifically, the underlying complaint alleged that the pledge, Jordan Hankins, was subjected to several instances of severe hazing. The complaint alleged that Jordan communicated to sorority members, including the defendants seeking coverage from Admiral, that the hazing actions triggered her PTSD and caused her to have suicidal thoughts and develop a plan for suicide. Jordan died by suicide in her dorm room.

Admiral disclaimed coverage for a defense and filed the declaratory judgment action. Among other reasons for not owing coverage, Admiral pointed to the policy’s exclusion for “Hazing, Sexual of Physical Abuse (sic) or Molestation,” which provides:

“It is agreed this insurance does not apply to ‘bodily injury’, ‘property damage’ or ‘personal and advertising injury’ arising out of hazing, sexual abuse, physical abuse or molestation committed by any insured. This exclusion applies only to insureds who participate in or direct others to participate in the hazing, sexual abuse, physical abuse, or molestation.”

The court noted that, on its face, the exclusion applied – and the insured did not argue otherwise.

Yet, the court still concluded that the exclusion did not apply. The court noted that some courts have held that “claims asserting negligent conduct such as the failure to seek medical assistance are independent from — and thus not excluded by — policy provisions excluding coverage for the injuries that necessitated medical intervention.”

Guess what case the court cited for this proposition. Get ready. Skolnik v. Allied Property and Casualty Ins. Co.

The court held that the “hazing exclusion” did not preclude a duty to defend. As hazing was not defined in the policy, the court turned to its ordinary meaning. Then, based on that definition, the court reached the following conclusion:

“On its face, however, this definition [of hazing] does not include defendants’ alleged failure to seek medical help or to report hazing, both of which omissions are among the grounds the UC identifies as giving rise to defendants’ liability. For these reasons, it is not clear from the face of the underlying complaint that Jordan’s death was caused solely by a proximate cause excluded by the Admiral Policy's hazing exclusion.”

This is Skolnik II.

There is no doubt that the “controlled substances exclusion” was intended to apply in Skolnik to an insured’s involvement in someone’s death by methadone intoxication. Likewise, there is no doubt that the “hazing exclusion” was intended to apply here. But, by simply alleging (provable or not) that, after the insured committed the excluded conduct, it failed to get help for the victim, the exclusion is inapplicable. This, despite that, if not for the insured committing the excluded contact, there would have been no need to seek help for the victim.

Policy drafters take note. The lesson is there for the taking.

|

|

|

|

|

Vol. 10 - Issue 3

April 28, 2021

Just In: Texas Supreme Court Issues Important Decision Concerning Settlement And Uncovered Claims [Top 10 Case Of 2021]

|

|

|

| |

There is no doubt that, when it comes to important courts for insurance coverage, the Texas Supreme Court is near, or even at, the top. In an earlier issue of CO I addressed the whys of this. So when the Texas Supreme Court handed down its decision, In re Farmers Texas County Mut. Ins. Co., No. 19-0701 (Tex. April 23, 2021), I took close note. However, the decision came down on Friday, just as I was wrapping up this issue. And my mojo to keep going was no more. So, while I see Farmers Texas as a very important decision, I just wasn’t able to address it in any detail. Here is the very brief moral of the story.

[I anticipate that Farmers Texas will make the 2021 “Top 10 Coverage Cases of the Year” list. So I’ll have a chance to delve into further in early 2022.]

Farmers Texas involves coverage for an automobile accident. Cassandra Longoria rear-ended a vehicle being driven by Gary Gibson. Gibson sued Longoria. She was insured under a policy issued by Farmers Texas County Mutual Insurance Company, which undertook her defense.

Gibson sought damages of $1 million. Longoria’s policy had a $500,000 limit. As trial approached, Gibson agreed to settle for $350,000. Farmers refused to contribute more than $250,000. As Farmers saw it, there was a coverage defense, which justified it paying less than the full demand. Longoria, concerned about her personal exposure, offered to pay the additional $100,000, but without waiving her right to seek recovery of that payment from Farmers. Gibson accepted and gave Longoria a release in exchange for Farmers’ and Longoria’s payments.

Longoria sued Farmers, alleging all manner of claims, and sought recovery of her $100,000 payment.

The Texas Supreme Court concluded that Longorio had a right to recovery. She still needed to do more to win, but the right existed.

In arriving here, the court cited to its well-known decisions in Frank’s Casing and Matagorda, which hold that “[i]f a liability insurer disputes whether some claims asserted against its insured are covered, it may comply with its policy obligations by defending under a reservation of rights, and it may settle the entire suit and—with the insured’s consent—reserve for separate litigation the question whether the insured should reimburse it for part of the settlement.” (emphasis added).

The Texas Supreme Court concluded that the matter at hand was reverse Frank’s Casing and Matagorda: “This approach also works the other way: if an insurer agrees to settle some claims but refuses to cover others, the insured may join with it to settle the entire suit and reserve for separate litigation the question whether the insurer should reimburse it for the remainder of the settlement.”

The court noted this caveat: “[A]n insured generally must show that the settlement amount ‘is one that a reasonable person who bears the sole financial responsibility for the full amount of the potential covered judgment would [pay].’ Restatement Of The Law Of Liability Insurance § 27(2)(d). If Farmers contends that Longoria should not receive full reimbursement because she paid an unreasonable amount to settle the remainder of the suit, the parties may introduce evidence on that issue in the trial court.”

There is more to the decision and other issues addressed, but this is the part that matters most.

|

| |

| |

| |

|

|

|

|

Vol. 10 - Issue 3

April 28, 2021

Federal Court Declines To Certify Important ALI "Restatement Of Liability Insurance" Issue To State Supreme Court

|

|

|

| |

The Arizona federal court’s decision in Tapestry v. Liberty Ins. Underwriters, No. 19-1490 (D. Ariz. March 29, 2021) is worthy of discussion for two reasons. First, the court addressed the sufficiency of a reservation of rights letter. That’s always an important issue. Second, the court was presented with the opportunity to certify, to the state supreme court, whether the ALI’s Restatement of Liability Insurance should control the issue. The court declined to do so. If it had, it would have set the stage for a significant, and no doubt high-profile, debate over the issue -- and a decision that could have had wide ramifications.

In very simple terms, at issue in Tapestry was whether an insurer waived a coverage defense – a “contract exclusion” -- by not including it in a reservation of rights letter. The insurer’s argument was that it did not, since it’s reservation of rights letter (or perhaps a disclaimer; it’s hard to tell) included a general reservation of rights. The insured, of course, argued that this general reservation of rights was not adequate.

Specifically, after expressly asserting coverage defenses for no “claim” made during the policy period, the construction defect exclusion and potential misrepresentation in the application, the letter stated that Liberty “expressly reserves all rights and defenses under the policy.”

The parties argued whether this general statement, of a reservation of rights, was sufficient to meet the requirement to “fairly inform” the insured of the insurer’s position -- that the “contract exclusion” could also preclude coverage.

The court pointed to Arizona case law that could go both ways and concluded that summary judgment was not proper:

“[I]n Mutual Insurance Co. of Arizona v. Bodnar, 164 Ariz. 407, 793 P.2d 560 (Ct. App. 1990), the Arizona Court of Appeals noted that if an insurer believes that a ‘valid exclusion’ would relieve it of a duty to provide coverage, the insurer must ‘communicate its reservation of rights to the insured to inform the insured of its position as to coverage.’ Id. at 412. Based on this language, a reasonable juror may conclude that, by its omission, Liberty waived its ability to argue that the contract liability exclusion was valid. On the other hand, in Equity General Insurance Co., 148 Ariz. at 517, the Arizona Court of Appeals found that a broad reservation of right ‘in a straightforward manner, informed a reader of average intelligence that while the insurer was providing a defense, it was doing so without waiving any rights to contest liability under the policy.’ Id. at 518. This would appear to support Liberty’s position that a reasonable juror could conclude that it clearly and properly notified of Tapestry of its ability to invoke the contract liability exclusion (as well as any other Policy provision).”

The court also declined to certify the following question to the Arizona Supreme Court: “Does an insurer’s failure, when undertaking defense of an action, to specifically reserve its right to deny coverage based on an exclusion that it has actual or constructive knowledge of result in loss of such ground for denial, without need for the insured to show prejudice, as provided in § 15 of the RESTATEMENT OF LIABILITY INSURANCE (2019) (the ‘RESTATEMENT’)? In other words, should Arizona adopt § 15 of the RESTATEMENT?”

Curiously, the court did not set about § 15 of the ALI Liability Restatement. Section 15 provides as follows:

§ 15. Reserving the Right to Contest Coverage

(1) An insurer may reserve the right to contest coverage for an action before undertaking the defense of the action if it gives timely notice to the insured of any ground for contesting coverage of which it knows or should know.

(2) If an insurer already defending a legal action learns of information, which it did not have constructive notice of under subsection (1), that provides a ground for contesting coverage for that action, the insurer must give notice of that ground to the insured within a reasonable time to reserve the right to contest coverage for the action on that ground.

(3) Notice to the insured of a ground for contesting coverage must include a written explanation of the ground, including the specific insurance policy terms and facts upon which the potential ground for contesting coverage is based, in language that is understandable by a reasonable person in the position of the insured.

(4) When an insurer reasonably cannot complete its investigation before undertaking the defense of a legal action, the insurer may temporarily reserve its right to contest coverage for the action by providing to the insured an initial, general notice of reservation of rights, in language that is understandable by a reasonable person in the position of the insured, but to preserve that reservation of rights the insurer must pursue that investigation with reasonable diligence and must provide the detailed notice stated in subsection (3) within a reasonable time.

It would have been interesting to see how Arizona’s top court addressed this. I have previously written about § 15 being one of the places in the Restatement that could cause insurers significant problems, specifically § 15(3)’s express statement of the “fairly inform” standard when it comes to drafting an effective reservation of rights letter.

|

| |

| |

| |

|

|

|

|

Vol. 10 - Issue 3

April 28, 2021

Bad Faith Failure To Settle -- But No Demand Within Limits, No Excess Verdict

|

|

|

| |

|

| |

There is a lot of lighthearted stuff in Coverage Opinions. But there is one thing that is never a joking matter around here: selecting cases for discussion. Of course, every coverage case is important for the litigants. And every case – even the most seemingly uneventful – can be important to someone dealing with that particular coverage issue.

My job is to choose cases that could be important or interesting for the CO readership at large – which has a wide range of coverage interests. I need to choose cases that as many readers as possible will find worthy of their time. I have a few categories of cases that have a strong enough reason to be selected for discussion in CO.

One of these – and a favorite of mine – it that the decision goes against conventional thinking -- on a national basis -- about an issue. In other words, the decision has a surprise element. And that’s what the California Court of Appeal’s published decision, in Planet Bingo LLC v. Burlington Insurance Co., No. E074759 (Cal. Ct. App. Mar. 18, 2021), is about.

The court determined that the insurer could be liable for bad faith failure to settle. However, here’s the rub – a settlement demand, within policy limits, was never made. Here’s the second rub – there was no excess verdict. And that’s because of the third rub – the underlying case against the insured never actually went to trial. Wait, there’s one more – the insurer secured a full release for its insured. Needless to say, these are certainly not the usual ingredients for an insurer to possibly be liable for bad faith failure to settle.

I’ll give away the ending here. The court concluded that when a settlement demand is for a subrogation claim, even if it is above policy limits, it could be deemed to be a demand for policy limits. This is because the court was persuaded that it is a very well-known industry custom, in subrogation claims, of accepting policy limits for a full release of the insured.

Second, the court found support for its subrogation-claim decision on the basis that, under California law, an insurer’s refusal, to simply disclose what its policy limits are, can be considered its refusal of an actual settlement demand made for policy limits.

Insurers usually find protection, for bad faith failure to settle, on the basis that there was never a demand to settle within limits made. In other words, the opportunity to settle was never there. Based on Planet Bingo, the analysis is not just mathematical.

Planet Bingo involves a protracted history and the facts are a little confusing. I’m going to stick to those that mattered the most to the court’s decision. At issue in Planet Bingo was coverage for a fire, in September 2008 in the United Kingdom, caused by an electronic gaming device designed and supplied by Planet Bingo. Leisure Electronics was the distributor of the devices. The fire took place at Beacon Bingo, a bingo hall in London. Plant Bingo sought coverage from its liability insurer, Burlington. The policy limit was $1 million.

In November 2009, Beacon Bingo notified Burlington that its damages totaled £1.6 million – about $2.6 million. In mid-2011, while neither Beacon nor Leisure had filed suit against Planet Bingo, the company advised Burlington that it was losing business because the fire claim remained unpaid and Plant Bingo “was getting known as a deadbeat.” Around that time, Burlington advised Planet Bingo that, since no claims were being pursued against it, the insurer was closing its file.

Meanwhile, AIG Europe Ltd., the insurer for Leisure, the distributor, settled with Beacon, the bingo hall, for £1.6 million. In July 2014, AIG contacted Planet Bingo, advised of the Leisure settlement, and made a subrogation demand of £1.6 million. AIG also stated that it was open to alternative dispute resolution. [I’ll get to the importance of the subro issue soon).

Planet Bingo notified Burlington of the claim. Burlington denied coverage on the basis that, as required by the policy, the fire did not occur in the United States or Canada and Planet Bingo had not been sued in the United States or Canada.

Planet Bingo’s attorneys convinced AIG it to sue Planet Bingo in the United States. AIG did so in California Superior Court. Burlington accepted the defense, subject to a reservation of rights, and settled with AIG for $1 million — the policy limits. AIG released any and all claims against Planet Bingo.

So case over, right? Sure, it took a long time to get there, but all’s well that ends well. Uh, no.

Planet Bingo had filed a coverage action against Burlington in 2016. Planet Bingo’s expert witness testified that “the failure to promptly pay the fire claim damaged Planet Bingo’s business reputation and ultimately caused its entire business in the United Kingdom to fail; as a result, it suffered lost profits of over $9.3 million. Burlington did not dispute this.” (emphasis mine).

The trial court ruled that Burlington was not liable for pre-litigation failure to settle. But the Court of Appeal reversed.

The appeals court, while noting that this was not a “paradigm case” of bad faith failure to settle – demand to settle within limits; insurer rejects it; case goes to trial; excess verdict – the insurer could be liable for pre-litigation failure to settle.

In making this determination, the court noted that, on its face, there was never a demand within limits on the table. AIG Europe demanded £1.6 million and Planet Bingo’s policy had a $1 million limit. And there was never an excess judgment. While AIG did have to sue Planet Bingo, Burlington settled for policy limits. However, Planet Bingo’s argument was that, by Burlington not settling pre-suit, its business in the UK was wiped out.

The court concluded that there may have been a demand to settle within limits. Wait, where? Well, that’s the surprising part. AIG’s £1.6 million demand was a subrogation demand. The court observed that, because it was a subrogation demand, it could have been considered a demand for limits.

The court explained: “It is significant that AIG was claiming as subrogee, and its letter was a subrogation demand letter. Planet Bingo’s expert witness testified that a subrogation demand letter ‘offers a clear invitation to negotiate a settlement for less than that amount . . . .’ She also testified that there is a ‘very well[-]known industry custom in such subrogation claims of accepting policy limits for a full release o[f] the insured.’ This raised a triable issue of fact as to whether the letter represented an opportunity to settle within the policy limits.”

Second, in reaching the conclusion, that a settlement demand can be a demand within limits, even if the demand is higher than the limits, the court was persuaded by Boicourt v. Amex Assurance Co., 78 Cal. App. 4th 1390 (2000), where an insurer’s pre-litigation refusal, to simply disclose what its policy limits are, could be considered its refusal of an actual settlement demand made for policy limits. The Planet Bingo court stated that, in Boicourt, the claimant, after getting an excess verdict, testified that he would have accepted policy limits if he knew what they were.

Planet Bingo isn’t over. It was a denial of summary judgment on the failure to settle issue. In addition, the court needs to decide whether Planet Bingo can recover lost profits rather than an excess judgment.

However, the take-away from Planet Bingo is clear. The court stated: “At a minimum, Boicourt [and now, seemingly, Planet Bingo] means that the existence of an opportunity to settle within the policy limits can be shown by evidence other than a formal settlement offer.”

|

| |

| |

| |

|

|

|

|

Vol. 10 - Issue 3

April 28, 2021

Insurer Wins Biggest ALI Liability Insurance Restatement Case To Date

|

|

|

| |

As I discussed in Coverage Opinions not long ago, there was a recent trio of decisions, over a three-day period, that looked to the American Law Institute’s Restatement of the Law, Liability Insurance for substantive guidance. I made much of this for two reasons.

First, for the near-three years since the Restatement has been adopted, courts’ citations to it had mainly been for benign reasons. In general, the ALI’s work played no real role in the decision except in a handful of instances. But then this February hattrick came along and I asked this question: Are courts’ use of the RLLI changing?

Second, throughout its long and contentious drafting process, there were numerous concerns raised by insurers, and their counsel, that the ALI was seeking to adopt positions in the RLLI that would lead to all manner of detrimental outcomes for insurers in coverage disputes. The RLLI was predicted by some to lead to cataclysmic consequences for liability insurers. After nearly three years, and several dozen decisions citing the RLLI, that had not come to pass. The sky was still in the sky.

And there was nothing in the February trifecta that changed that. The courts did not use the decisions to change existing law, but, rather, as a resource where their own state lacked guidance. The RLLI was used to fill that crevice. And, given how well-developed coverage law is on so many of the key issues, there aren’t a huge number of places where these voids exist.

Nautilus Ins. Co. v. Access Med

Afew days after that CO piece came out, the Supreme Court of Nevada issued its decision in Nautilus Ins. Co. v. Access Med, No. 79130 (Nev. Mar. 11, 2021). The court, with several nods to the RLLI, answered the following certified question from the Ninth Circuit:

“Is an insurer entitled to reimbursement of costs already expended in defense of its insureds where a determination has been made that the insurer owed no duty to defend and the insurer expressly reserved its right to seek reimbursement in writing after defense has been tendered but where the insurance policy contains no reservation of rights?”

The Silver State high court, in a 4-3 decision, answered “yes.”

Once again, the court used the RLLI simply in the context of filling a hole in its own law and not to upset existing jurisprudence. And, notably, it was the court’s rejection of the RLLI-adopted rule that was part of its reasoning for the insurer winning the case. The dissent, by contrast, used the RLLI to support its position. Coming from a state supreme court, Access Med is the first decision to use the RLLI in the process of making new law.

The reimbursement of defense costs tune has been sung many times by courts. The arguments for and against it are a broken record – and Access Med is no exception (although the decision does a good job of laying out the competing arguments). So I’ll skip that part here. Instead, I address where the RLLI played a part in the decision.

By way of very brief background, Nautilus undertook it insured’s defense, under a reservation of rights, for a CGL claim with a possible allegation of “personal injury.” The ROR included the right to seek reimbursement of defense costs, if a court determined that no potential for coverage existed. The insureds did not object. Simultaneously, Nautilus filed an action, in Nevada federal court, seeking a declaratory judgment that it had no duty to defend. Nautilus succeeded, obtaining a determination that the complaint against the insured did not allege defamation, libel, or slander under California law.

Now Nautilus sought reimbursement of its defense costs. Nautilus lost at the District Court. The Ninth Circuit certified the reimbursement question to the Nevada Supreme Court, which answered as follows:

“When a court determines that an insurer never owed a duty to defend, the insurer expressly reserved its right to seek reimbursement in writing after defense was tendered, and the policyholder accepted the defense from the insurer, then the insurer is entitled to that reimbursement. Under generally applicable principles of unjust enrichment and restitution, the insurer has conferred a benefit on the policyholder; the policyholder appreciated the benefit; and, because it is reasonable for the insurer to accede to the policyholder’s demand, it is equitable to require the policyholder to pay. This result gives effect to the parties’ agreement, as well as the court’s judgment, by recognizing that the insurer was never contractually obligated to furnish a defense.”

Where the RLLI Comes Into the Access Med Decision

In reaching its decision, to allow for insurer reimbursement of defense costs, the Access Med court noted that the RLLI adopted a rule against reimbursement, but the ALI also recognized that a “slight greater number of state courts” have permitted reimbursement. The fact that the majority rule nationally is to allow for reimbursement of defense costs certainly did not carry the day for the insurer, but it seems to have given it a little boost.

In addition, the Access Med court made this important point in the context of discussing the reimbursement scoreboard: “We note that the Restatement of Liability Insurance justifies its departure from the usual rule by reference to ‘special considerations of insurance law’ that make insurance policies fundamentally different from other contracts. Restatement of Liability Insurance, § 21, cmt. b. That reasoning is inconsistent with our precedent that ‘legal principles applicable to contracts generally are applicable to insurance policies.’ Century Sur., 134 Nev. at 821, 432 P.3d at 183.”

The significance of this statement is that the Nevada high court declined the follow the RLLI in the face of contrary home-state precedent. This supports an argument that the RLLI’s role is to fill voids in state law and not overturn existing law.

Three Justices, noting that the RLLI rule does not permit reimbursement, used that as support in their dissenting opinion. The dissent noted that the RLLI favors the argument that an insurer’s unilateral reservation of rights, giving itself a right to reimbursement, is an impermissible modification of the policy. The insurer’s right to reimbursement, as the RLLI sees it, must be stated in the policy -- for both legal and practical reasons.

While the ALI’s Restatement of the Law, Liability Insurance got off to a slow-start for the first three years, playing a substantive role in just a handful of several dozen decisions citing to it, do these four recent decisions, over a short period of time, foretell a new story?

|

| |

| |

| |

|

|

|

|

Vol. 10 - Issue 3

April 28, 2021

Federal Court Addresses The "Professional Services" Problem That Some Insurers Are Bringing Upon Themselves

|

|

|

| |

I have been talking about this issue for a long time: the challenges that insurers have faced in determining whether injury or damage was caused by a “professional service.” The issue usually arises in determining whether the insuring agreement, of a professional liability policy, has been satisfied, as well as whether a “professional services” exclusion, in a commercial general liability policy, is applicable.

The number of disputes and amount of case law addressing this issue is remarkable. By my count, in 2020 alone, there were at least 20 decisions that addressed whether conduct as issue, for purposes of determining coverage, involved the performance of a “professional service.”

Insurers have it in their hands to correct this situation – or at least make a good effort – but many don’t, despite all of the evidence that they should. Instead, they continue with disputes and coverage litigation over the meaning of “professional services.”

Late last month an Oklahoma federal court addressed this issue. The insurer lost. There is no doubt in my mind that the policy at issue was not intended to cover the claim. But the commercial general liability policy did not define the term “professional services” in an exclusion. And that was the insurer’s self-inflicted undoing.

Here is my latest bark on the issue. The question in Am. Nat’l Prop. & Cas. Co. v. Select Management Group, No. 20-542 (N.D. Okla. Mar. 23, 2021) was coverage for a real estate broker, Michelle Bradshaw and related corporate entities, for a claim for bodily injury sustained by another real estate broker, Kathleen Barnes.

Bradshaw was the listing agent for a home in Broken Arrow, Oklahoma. Barnes was showing the home to clients. While in the backyard, a dog – whose presence was not disclosed in the listing information – came from the side of the house and began to approach. Barnes ran toward the back door, tripped and broke her arm.

Bares sued Bradshaw and certain related entities (collectively “Bradshaw” here). Bradshaw sough coverage under a commercial general liability policy. The insurer, Am. Nat’l Prop. & Cas. Co., filed an action seeking a determination that it owed no obligations on account of the CGL policy’s “Professional Services” exclusion.

The “Professional Services” exclusion did not define the term “professional services.” It simply included a non-exhaustive list of services that are “professional services.” With the wee-bit possible exception of legal, nothing on the list of examples of “professional services” even came close to what a real estate agent does, unless real estate agents perform gall bladder surgery, dispense drugs, sell eye glasses or remove hair. The list of “professional services,” with no relevance to what a real estate broker does, goes on.

American National’s argument was summed up by the court this way:

“[E]ven though real estate services are not among the enumerated examples, it is nevertheless a ‘professional service’ within the meaning of the exclusion because a real estate agent ‘likely has a specialized skill and knowledge regarding what disclosures she needs to make’ when listing a property. Accordingly, because Ms. Barnes’s injuries resulted from Ms. Bradshaw’s alleged failure to warn of the dog when listing the property, American National says its policy does not cover Ms. Barnes’s claims.”

The Court disagreed. It turned to a common definition of “professional services” used by courts around the country:

“The act or service must be such as exacts the use or application of special learning or attainments of some kin[d]. The term ‘professional’ in the context used in the policy provision means something more than mere proficiency in the performance of a task and implies intellectual skill as contrasted with that used in an occupation for production or sale of commodities. A ‘professional’ act or service is one arising out of a vocation, calling, occupation, or employment involving specialized knowledge, labor, or skill, and the labor or skill involved is predominantly mental or intellectual, rather than physical or manual.”

The court explained it decision as follows:

“Here, the omission in question—Ms. Bradshaw’s alleged failure to warn of the dog when listing the house—occurred while Ms. Bradshaw was acting in her capacity as a real estate agent, but the allegedly negligent act had nothing to do with the ‘specialized knowledge’ that might make the sale of real estate a ‘professional service.’ To the extent real estate agents have special knowledge about what information must be disclosed in a listing, that expertise would seem to concern information that buyers need in order to make an informed, legally binding offer.”

I can see the argument that, when putting together a real estate listing, the professional aspect, regarding which information to include, has to do with what the buyer needs to know to make an informed buying decision.

But, at the same time, I believe that the court got it wrong and some courts would have come out the other way, concluding that putting together a real estate listing, without regard to the particular information, is a “professional service.” Now, is there an obligation to include, on the listing, the fact that there is a dog at the home? That’s a liability/duty issue for the plaintiff to prove.

There is no doubt in my mind that the insurer did not intend to cover this claim under a CGL policy.

Of course, this could have been avoided, or at least the insurer could have had a better chance of prevailing, if it had defined “professional services” in the exclusion, and done so in a manner that was tied to the insured’s profession as a real estate broker.

|

| |

| |

| |

|

|

|

|

| |

|

|

This is one of those times when there are so many cases worthwhile of discussion that I am forced to present many in “Tapas style.” It would take too long to do full-blown case write-ups of all of them. So I’ll keep these brief and just focus on what matters in the decision. If the issue is of interest to you, well, it’s easy enough to find the full case and get the rest of the story.

Reminder: CGL Policy Does NOT Provide Coverage For Damages “For Bodily Injury or Property Damage”

I’ve said this a lot. Despite it frequently being talked about that a commercial general liability policy provides coverage for damages for “bodily injury” or “property damage,” it does not. A CGL policy, rather, provides coverage for damages because of “bodily injury” or “property damage.” There can be a difference between “for” and “because of” when it comes to CGL coverage. This was on display in McDonald’s Corp., et al. v. Austin Mutual Ins. Co., No. 20-05057 (N.D. Ill. Feb. 22, 2021), a case addressing CGL coverage for a Covid-19 claim.

McDonalds and franchisees sought CGL coverage for a suit by employees for public nuisance and negligence in the decision of McDonald’s to remain open during the COVID-19 pandemic without enhanced health and safety standards. In summary, “[t]he Massey plaintiffs specifically seek a mandatory injunction requiring Plaintiffs to, among other things: (1) provide their employees with adequate personal protective equipment; (2) preclude the reuse of face masks; (3) supply hand sanitizer; (4) require that customers wear face masks; (5) monitor employee COVID-19 infections; and (6) provide Plaintiffs' employees with accurate information about COVID-19.” Three of the plaintiffs had contracted Covid-19 or experienced symptoms.

The court concluded that a defense was owed – and the decision had a lot to do with the words “because of” in the insuring agreement. The relief sought, such as providing personal protective equipment, precluding the reuse of face masks and supplying hand sanitizer, was not “for” bodily injury.” However, while the court noted that its argument may not “wow anyone with its brilliance” – and based on a low standard for establishing a duty to defend -- such relief is “because of” “bodily injury.”

The court stated: “The Policies do not say ‘proximately because of” —they merely say ‘because of,’ so simple ‘but for causation is enough. As applied here, Plaintiffs have adequately alleged ‘but for’ causation because ‘but for’ the Massey plaintiffs’ actual contraction of COVID-19, the Plaintiffs would not have to incur ‘damages’ to comply with a mandatory injunction.”

Federal Appeals Court Addresses When The Duty To Defend Ends [And Addresses ALI Restatement of Liability Insurance]

Generally speaking, many courts state that an insurer’s duty to defend ceases once there are no longer any potentially covered claims at issue in the underlying litigation. Sometimes this gives rise to issues with how to apply such rule.

In Westminster Am. Ins. Co. v. Spruce 1530, No. 20-2470 (3rd Cir. March 18, 2021), the Third Circuit Court of Appeals addressed the issue. The insured, Spruce 1530, had sought a determination that, despite there being no covered claim remaining in the litigation – a claim for malicious prosecution had been dismissed -- an insurer’s duty to defend existed through the conclusion of litigation. The policyholder advocated that the court should adopt this rule, just as the Hawaii Supreme Court did in its 1992 decision in Commerce & Industry Ins. Co. v. Bank of Hawaii. The insured also pointed to the ALI’s Restatement of Liability Insurance as support for this rule.

But the Third Circuit declined, instead sticking with the rule that the lack of any potentially covered claims terminates the duty to defend. The appeals court observed that “in the nearly thirty years since Bank of Hawaii’s decision, we are aware of no cases where a Pennsylvania court has adopted Spruce’s favored approach. Pennsylvania’s decades of silence ring louder than voices from other jurisdictions and treatises.”

Coverage Counsel Must Provide Legal Advice And Not Handle Claims - Or Insurer Risks Attorney-Client Privilege

I addressed this issue in the 2020 Top 10 Cases of the Year article. When an insurer hires outside coverage counsel, and counsel acts to handle a claim, and not provide legal advice on whether coverage is owed, the insurer risks waiving attorney-client privilege. A North Carolina federal court provided a reminder about this in United States Tobacco Coop. v. Certain Underwriters at Lloyd’s, No. 19-430 (E.D.N.C. Apr. 9, 2021).

The decision is long and resolves many discovery disputes. Let’s just say it didn’t go well for the insurer. This was foreshadowed by the opinion’s opining sentences: “If someone unfamiliar with federal litigation were to review the Defendant Insurers’ conduct here, they would be left with the distinct impression that compliance with the Federal Rules was optional. Or, at best, they would conclude that there was no penalty for disregarding them. But that is not the case.”

On the issue of attorney-client privilege, the court stated:

“Determining the applicability of the privilege is particularly challenging in the context of insurance companies. When attorneys act in a claims handling capacity, the attorney-client privilege does not attach to communications with those attorneys and the insured or its agents. The mere fact that an attorney participates in an investigation will not shroud communications in privilege where they occur in an insurer’s normal course of business. Instead, for insurance matters, the attorney-client privilege attaches when an attorney performs acts for an insurer in his processional [sic] capacity an[d] in anticipation of litigation.

The Supreme Court of North Carolina has not opined on this issue, but it is reasonable to believe it would reach a similar result. North Carolina’s test for the attorney-client privilege requires that the communication relate to a matter about which the attorney is being professionally consulted and that the communication relates to the giving or seeking of legal advice. Generally, claims handling and insurance adjusting do not fall within these categories.”

Federal Court Allows Complaint To Be Filed Against Insurer’s Agent Or Claims Handler For Bad Faith

I can’t say a lot about Microbilt Corp. v. Certain Underwriters at Lloyds, No. 20-12734 (D.N.J. March 31, 2021). That’s because there isn’t a lot to say. In a brief opinion, the court allowed an insurer to file an amended complaint against CFC Underwriting Limited for bad faith in connection with delayed payments for defense costs. The insured had sought to file the amended complaint after Lloyds and CFC made a motion to dismiss the claims against CFC, in the original complaint, on the basis that CFC was not a party to the insurance policy. So the insured now sought to add clams against CFC as “Underwriters’ agent or claims handler.”

The standard for a court to allow the filing of an amended complaint is not high, as the court pointed out. The insured cleared the hurdle. In doing so, the court concluded – against arguments to the contrary -- that claims for breach of contract and negligence, against a party that is not a party to an insurance policy, are not futile.

The court explained its reasoning: “In Pickett v. Lloyds, the New Jersey Supreme Court held that Peerless, the insurance company’s agent, was liable to the insured in contract for lack of good faith and fair dealing outside of its agency relationship with Lloyd’s for its role in the claims handling delay that caused consequential damages to the policyholder. The court found that Peerless’ conduct contributed to the delay that led to the consequential damage. Similarly, here, in its proposed amended complaint, Plaintiff alleges that CFC’s conduct contributed to or caused Plaintiff’s damages. The Pickett case shows that although an agent such as CFC may not have been a party to the contract, it can still be liable for breach of contract and/or tort.” (internal citations omitted).

It’s still early, but Microbilt has gotten past the courthouse metal detector with a bad faith claim against an insurer’s “agent or claims handler”-- for delays in paying defense costs.

This Argument For Coverage Had No Chance – But The Lawyer Gets An “A” For Effort

Stephanie Chamberlain, while intoxicated, crashed her car into a vehicle driven by Pedro Chang, causing him serious injury. Chang sued Chamberlain. Chamberlain did not have auto insurance. But she did have a homeowner’s policy. Not surprisingly, Foremost, the insurer, denied coverage for the Chang suit on the basis of the homeowner’s policy’s exclusion for, in general, bodily injury arising out of the use of a vehicle.

Putting aside some procedural issues and a settlement, the court in Foremost Ins. Co. v. Chang, No. 18-718 (W.D. Ky. March 19, 2021) addressed the applicability of the motor vehicle exclusion to a claim by Chamerlain for causing injury while driving a vehicle. The court concluded that the exclusion was, get ready, applicable, as there was a “causal connection” between Chamberlain’s use of her vehicle and Chang’s injuries.

To his credit, with his back to the wall, Chang’s counsel make a novel argument. It was rejected, but gets a high mark in the category of a lawyer doing his or her best when dealt a bad hand: “Chang does not question the causal connection between Chamberlain’s use of her car and his injury. Instead, Chang argues that Chamberlain’s failure to buy auto insurance was both negligence per se and the proximate cause of Chang’s injuries. But even accepting Chang’s proposition, his argument still fails for the same reason the parents’ argument in Hugenberg failed—that is, even repackaging the alleged negligence in a manner that distances the claim from the use of the motor vehicle, the repackaged claim nevertheless is ‘causally connected’ to the automobile crash. ‘If not for [Chamberlain] losing control of the car and injuring [Chang], there could be no claim for [negligence or negligence per se in failing to procure auto insurance] against [Chamberlain] because [Chang] would have suffered no injury, an essential element of the tort.’ Hugenberg, 249 S.W.3d at 187. The whole reason Chamberlain’s lack of automobile insurance affects Chang is that she crashed her car into Chang, injuring him.”

Another Court Affirms The Principle That An Insurer Being Wrong Is Not Bad Faith

Despite some policyholder counsel needing to breathe into a paper bag when asserting that an insurer commits bad faith because its coverage determination is wrong, the law does not support such wishful thinking. When insurers commit bad faith, it usually has to do with the manner in which a claim was handled, such as deficiencies in the investigation or failure to settle. Just getting the decision on coverage wrong rarely meets the high standard needed to clear the relevant state’s bad faith hurdle. I’ve said this a lot in these pages over the years and now I can say it again.

In My Choice Software v. Travelers, No. 19-680 (C.D. Calif. March 17, 2021) the federal court addressed whether Travelers, which the Ninth Circuit had earlier concluded reached an erroneous decision to deny coverage based on an intellectual property exclusion, committed bad faith in doing so. The court concluded that the insurer did not, despite its observation that “none of the factual scenarios in any of the cases that Travelers claims support its ‘objectively reasonable’ decision to decline coverage are on all fours with the present case. This is likely why the Ninth Circuit declined to find the cases applicable.”

However, the court concluded that it was still not bad faith: “[C]ontrary to MyChoice’s assertions that Travelers engaged in bad faith by deliberately misleading the Court by making unsupported analogies to case law, Travelers was merely taking a reasonable but, ultimately misguided, position in a matter of first impression. Accordingly, the Court finds that Travelers’s decision to decline coverage was not unreasonable as a matter of law.” Further, “the mere fact that there was not case law directly on all fours with Travelers’s position does not render the decision to decline coverage unreasonable.”

Oregon Federal Court Upholds China Forum Selection Clause

Thanks to the Oregon federal court’s decision in JPaulJones, LLC v. Zurich General Ins. Co. China, No. 20-1767 (D. Ore. Apr. 9, 2021), a putative additional insured, located in Austin, may be headed to China to litigate a coverage action. JPaulJones, LLC, a vacuum cleaner designer, hired TEK Electrical Co. to manufacture JPaulJones’s vacuums at a factory in China. TEK was insured under a general liability policy issued by Zurich General Ins. Co. (China) and JPaulJones was an additional insured.

Something happened – it’s not clear – and claims were filed against JPaulJones in several U.S. states. JPaulJones sought a defense under the Zurich-China policy issued to TEK. Zurich disclaimed coverage, for certain claims, on the basis of some sort of time of occurrence issue (also not clear). JPaulJones filed a coverage action, that got to Oregon federal court, and Zurich-China argued that, based on a forum selection clause in the policy, such litigation must be brought in China. Not surprisingly, JPaulJones objected to this, arguing that it “would effectively render the purported coverage illusory,” as it “would create an insurmountable challenge for most insureds.”

In a somewhat lengthy opinion, addressing several issues and citing lots of law, the court held that the litigation was to be shipped to China – or at least it wasn’t going to stay in Oregon.

There’s a lot that I could say about how the court reached its decision, but it is well beyond the scope here. If you are dealing with a forum selection issue, the opinion is most certainly worthwhile reading.

Georgia Federal Court Holds That Pollution Exclusion Does Not Apply To Construction Dust

In an opinion significantly longer than it needed to be, a Georgia District Court held in Lang v. FCCI Ins. Co., No. 19-3902 (N.D. Ga. March 30, 2021), that the pollution exclusion precluded coverage, under a commercial general liability policy issued to a construction company, for a claim that dust, from its work, caused a nearby resident to sustain breathing problems.