|

|

|

|

|

Vol. 6 - Issue 4

April 12, 2017

|

|

|

|

|

|

|

My phone rang at 4 p.m. on the dot. I knew the caller was Gloria Allred. For some people, picking up the phone and hearing the renowned women’s rights lawyer on the other end has not been welcomed. But not here. It was something I’d long been trying to make happen.

Allred’s schedule is manic, and it took many months for our call to come together. All the while she was apologetic and offered that I keep reaching out to her. On a Sunday afternoon in late March the pieces fell into place.

Allred greeted me warmly and acknowledged my patience. I asked if she was calling from Malibu, where I know she has a second home on the beach. She is. She told me she’s staring at the ocean. I, too, have a view of the water. It’s raining in Philadelphia.

Allred, 75, is one of the best-known lawyers in America. But this achievement has not come without a price. Her countless high-profile cases, often with a celebrity component, have overshadowed some of her lesser-known, including ground-breaking, work. Such drowning-out is inevitable when you accuse behemoths like Bill Cosby and President Donald Trump of sexual misconduct. Or represent Tiger Woods’s mistresses. |

|

|

|

| |

But Allred’s career is far from merely those made-for-TMZ cases. Few probably know that Allred successfully represented a male couple, in a suit against a photographer, over his refusal to include their photograph in a high school reunion yearbook. This sounds a lot like the frequent cases these days against bakeries, over refusing to make wedding cakes, for same-sex couples. Except there’s one difference. Allred sued the photographer 30 years ago. And 33 years ago, Allred prevailed in a suit brought on behalf of a lesbian couple who were denied the right to sit in a semi-private booth in a restaurant. And then there’s the man with AIDS Allred represented, who, in 1986, he denied the right to a pedicure in violation of a West Hollywood ordinance.

Such is the paradox of Gloria Allred—much is unknown about such a well-known lawyer.

All of this is to say that Allred has been at it for a long time. She told me that her representation of gays and lesbians in the 1970s and 1980s, in what she noted were “pioneering cases,” was at a time when “many people didn’t want to do gay and lesbian rights cases because lawyers were afraid that they would be called a lesbian or a gay person, as though that were something bad or to be avoided. But I didn’t really care. I only cared what the rights of my clients were.”

Allred’s support for same-sex couples was on a very large stage in 2008 when she successfully represented a lesbian couple, before the California Supreme Court, winning for them the right to marry. (The opinion needs eight single-spaced pages just to list the lawyers and amicus parties involved.)

Meeting the Press

Allred is famous for holding court at press conferences to announce her cases. The 5’2” Allred can be seen seated behind a sea of microphones, filleting her target. You can practically picture the guy looking for his check book before the press conference is over. But this certainly wasn’t the case recently when she represented a weather news anchor, against television stations, for their refusal to hire her client because of gender and age. There was no quick settlement here. The case went to the California Court of Appeal – twice. Oh, and Allred’s client was a man.

While virtually all civil cases settle, I wondered if Allred’s do so more quickly—to avoid, as I put it, “the Gloria Allred factor.” Allred shares that there’s a value in early settlement, but not for the reason I suggested. It’s because, she tells me, that her firm has “proven that if the case doesn’t settle, we will litigate it for as long as our client is willing to litigate it and in some cases for years.” The litigation against the reunion photographer lasted 10 years. Allred tells me that the case on behalf of the AIDS-affected man who was denied a pedicure, went on for 16 years, even after he died, “because the issues that were involved were so important.” And she recounted for me her 23-year battle against the Catholic Church in one of the earliest priest abuse cases.

While Allred does seem Forrest Gump-like when a woman has been mistreated by a well-known man, sometimes as a cad and other times far worse, “Most of our cases have nothing to do with celebrities,” she tells me. That she is just a lawyer “helping to improve the status and condition and the lives of women [and minorities] so that they are able to enjoy equal protection under the law” is a common refrain by Allred throughout our call.

A Career in the Mirror

In many ways, Gloria Allred’s career resembles Gloria Allred. She grew up in Philadelphia, the child of a working class family. Married during her sophomore year at University of Pennsylvania, a mother at age 19 and divorced by her senior year, Allred was forced to sue her ex-husband for child support. Years later Allred took on the fight for legislation to assist with child support collection. In 1985 she staged a sit-in, at the office of the L.A. District Attorney. She was locked in the building overnight, after he wouldn’t meet her to discuss child support enforcement. The following year, Allred was handed the President’s Volunteer Action Award by Ronald Reagan for her work on child support enforcement.

After college graduation, the future discrimination attorney took a job as an assistant buyer at Gimbels department store. She learned that she was making 15 percent less than a man in the same position. Allred decided to try teaching and commuted from Philadelphia to New York to get her master’s at New York University. She ended up at an almost all African-American high school in Philadelphia. Here, she says, she was exposed to the problems of minorities.

In 1966, Allred headed West to Los Angeles, and taught high school in the city’s Watts neighborhood. That same year Allred had an experience that would send her to law school to pursue a career as a lawyer for women’s rights. While on vacation in Acapulco, she was raped at gunpoint. Allred returned home and learned she was pregnant. A then-illegal abortion ensued and Allred nearly died. Despite a 106-degree fever she feared going to the hospital because the abortion had been illegal. Allred has long been committed to assuring the availability of safe and legal abortions. “I don’t want anyone else to have to suffer what I had to endure. not knowing whether I would live or die from an unsafe and illegal abortion.”

Allred graduated from Loyola School of Law in Los Angeles in 1974 and did the unusual – she started a law firm shortly thereafter. Along with two classmates, Michael Maroko and Nathan Goldberg, the firm Allred, Maroko & Goldberg was formed. And then the unimaginable took place – 41 years later the three are still partners in the 12-attorney firm.

The earlier part of Allred’s career is dotted with several cases where principles, and not money, were the real focus. In 1984 she successfully sued a dry cleaner because it was charging 40 cents more to clean a woman’s shirt than a man’s. The case settled within hours. Obviously it wasn’t about a quarter and three nickels. Allred’s class action again Saks Fifth Avenue forced the retailer to stop its nationwide practice of charging women for alterations, but not men. Allred’s youngest client in a sex discrimination suit was a three-year-old girl whose mother was charged $2 more for a haircut than if she had been a boy. Her 1985 lawsuit put an end to this discriminatory pricing.

I commented that these discrimination cases took place in a different era and such practices seem unfathomable when viewed through a 2017 lens. But Allred said that she is “aware that there is still a great deal of discrimination that often is severe and it’s pervasive and it’s harmful.” She encourages people to turn to small claims court if they have the evidence.

Allred’s early successes weren’t just about women being discriminated as consumers. She also had the workplace in her crosshairs. In 1988, following an eight-year battle, Allred prevailed in a U.S. Court of Appeals for the Ninth Circuit case (called “landmark” by the L.A. Times) that placed restrictions on an employer’s right to ask a prospective employee about off-the-job sexual activity.

The Celebrity Lawyer

Allred knew, going in, that the story I wanted to tell was of the lesser-known aspects of her career. As we wrapped up after 30 minutes, I told her that I achieved my objective: not a single celebrity name was spoken on the call—except hers, I joked. But she dismissed that notion.

“I don’t think of myself as a celebrity,” she said. “I just think of myself as a lawyer who is doing the work that we can to protect our clients’ rights and to win them as much justice as is possible under the law.”

But Allred acknowledged that she is approached in public, often by women who thank her for what she does or have questions about how they can assert their rights if they’ve been victimized. She doesn’t mind it, she told me, and is happy to offer suggestions. But she also wanted me to know that she is approached by men, who tell her that they are happy for what she does because “it’s important for the future of their daughters.”

Allred is at the age, and seemingly has nothing left to prove, where the question had to be asked: How much longer do you plan to go at it? Her response was immediate and unambiguous:

“For as long as I can keep working and being effective for my clients I am going to,” she said. “There is nobody in my law firm or my life who would even think that I would ever retire. Because they know I never will.”

That I’m speaking to Allred on the day the Lord set aside for rest is of no significance to her. She explained that she doesn’t take weekends, holidays or vacations. Before our call she was on her computer working and that’s where she’ll be when we finish, I’m told. She travels the country for her cases and has an office in New York, where she is admitted to practice. She tells me that she loves what she does, is blessed to do it, has a duty to do it, is in great health and has boundless energy.

“Even after I’m no longer physically on this earth, I’ll find a way to keep up the important work for women’s rights and minority rights.”

|

| |

|

|

|

| |

|

|

|

|

Vol. 6, Iss. 4

April 12, 2017

What To Name An Insurance Company: Insurers Take Every Approach Imaginable

|

|

|

|

|

| |

There are a lot of property-casualty insurance companies out there. And when it comes to giving themselves names, they seem to take every approach imaginable. Some companies go the bland route – Accident Insurance Co. Man I hope they didn’t pay a branding consultant for that. Others are as far from bland as you can get, such as Lightening Rod Mutual Insurance Company. Man I hope they didn’t pay a branding consultant for that.

Some insurance companies like animal names. I’d love to see Blue Whale Re Ltd. sue Golden Bear Insurance Company and then a third-party complaint filed against Lion Insurance Company.

I wonder if Balboa Insurance Company and Lewis & Clark LTC RRG, Inc. ever get together and share exploring tips. And do Pilgrim Insurance Company and Plymouth Rock Assurance Company have Thanksgiving dinner together?

Le Mars Insurance Company probably says that its claims service is out of this world. There are insurers that choose names so you have no doubt where they are located. No problem finding San Antonio Reinsurance Company. I wonder if it’s located near Alamo Title Insurance.

Lots of insurance companies seem to like the name Farmers. I’m sure there isn’t too much confusion between those 30 or so companies. Some insurers want to leave no doubt about what they insure. Guess what kind of insurance The Dentists Insurance Company sells. Ok smart guy, try this one – Podiatry Insurance Company of America.

There are many insurers that include the world old in their name. But not Modern USA Insurance Company. There are insurance companies that want you to know that they are strong. Don’t even think about messing with Olympus Insurance Company. The nation’s oldest insurance company might just also have the longest name – Philadelphia Contributionship for the Insurance of Houses from Loss by Fire, Inc. Wow. That’s a mouthful. Some insurer’s names are just fun to say, like Pymatuning Mutual. And my favorite -- Elephant Auto Insurance Company. I guess they sell their policies for peanuts.

[Principal Source: Best’s Key Rating Guide, Property/Casualty 2016] |

| |

That’s my time. I’m Randy Spencer. Contact Randy Spencer at

Randy.Spencer@coverageopinions.info |

| |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vol. 6, Iss. 4

April 12, 2017

Encore: Randy Spencer’s Open Mic

Court Addresses Cyber Coverage And Barry Manilow

|

|

|

|

|

| |

|

| |

Not a day goes by it seems without news of a cyber attack resulting in the release of 4 trillion people’s personal information. It has gotten to the point where one’s identity could seemingly be stolen several times a month. Perhaps the solution for identify theft is to simply wait for your fake identity to be stolen. Clearly not all data breaches -- and probably most do not -- cause any identifiable or quantifiable harm to the person whose personal information was so-called “compromised.” After all, for decades there was a major breach of personal information that didn’t seem to bother anyone – it was called The White Pages.

Looking at the insurance side of things, it has also been all-cyber all-the-time. Insurers have been actively marketing cyber insurance policies and coverage professionals have been analyzing the claims – real and potential. We are likely on the cusp of lots of coverage claims, and possible disputes, under all of these new-fangled cyber policies that are being sold. For now, the cyber/data breach coverage issues have been tied to plain old commercial general liability policies. [But this will likely diminish soon on account of data breach exclusions being added to CGL policies, in addition to the popularity of specialized cyber policies.]

While cyber/data breach coverage cases under CGL policies are not long for this world, last week’s decision from an Oregon trial court demonstrates the fun that we’ll be missing. In Oscines v. Mt. Hood Insurance Company, Circuit Court of Oregon, Benton County, No. 1401-426 (July 2, 2015), the Oregon trial court addressed the potential for coverage, for a data breach, under a commercial general liability policy. The coverage dispute arose out of the following situation, as described in the underlying complaint at Billingsley v. Oscines, LLC, Circuit Court of Oregon, Benton County, No. 1401-125.

Chuck Billingsley was an accountant in Corvallis, Oregon. But his hobby was far removed from counting beans. Billingsley participated in “tough guy” competitions. As the court described it, the participants compete in races while hauling heavy and bulky items such as truck tires and bricks. Other competitions involve tearing phone books, pulling trucks, lifting boulders and chopping wood. The court made the point, for a reason, that being a “tough guy” had become Billingsley’s ingrained identity.

Billingsley kept his music library on a music server called Oscines (Latin for song bird). In October 2013, Oscines’s server was hacked and the identity of all of its users, and the contents of their music libraries, became public on the internet. As a result, it became known that Billingsley’s music library included several albums from Barry Manilow, Neil Diamond, Abba and the Carpenters. The information also revealed that Billingsley had once played Copa Cabana 32 times in a five hour period. This resulted in Billingsley being teased by other “tough guy” competitors. He also alleged that a co-worker hummed Dancing Queen when he walked into a meeting and that the disc jockey at the company’s holiday party played The Carpenters’s Rainy Days and Mondays and dedicated it to him. Billingsley alleged that the release of this information, given his public persona as a “tough guy,” caused him extreme emotional distress. Billingsley filed suit against Oscines seeking damages for invasion of privacy.

Oscines tendered the suit to Mt. Hood Insurance Company and sought coverage under a commercial general liability policy. Mt. Hood denied a defense on the basis that the allegations against Oscines, in Billingsley’s suit, did not trigger coverage. Specifically, Mt. Hood argued that Billingsley was not injured on account of the “oral or written publication, in any manner, of material that violates a person’s right of privacy.” So the insurer’s argument went, the Billingsley suit did not seek damages for “personal and advertising injury” to trigger coverage under the CGL policy. Shortly after the denial of coverage, Billingsley and Oscines settled the matter for $65,000. Oscines then filed suit against Mt. Hood for the recovery of the settlement amount and $8,000 in defense costs.

The parties in the coverage dispute filed competing motions for summary judgment. The trial court in Oscines v. Mt. Hood held that Billingsley had alleged that he was injured on account of “oral or written publication, in any manner, of material that violates a person’s right of privacy.”

First, the court concluded, despite Mt. Hood’s argument to the contrary, that there had been oral or written publication, in any manner, of material. Mt. Hood argued that there is nothing oral or written about the actions of a hacker and subsequent release of information on the internet. As Mt. Hood saw it, hacking does not involve speaking or the written word. The court pointed to the “in any manner” language and concluded that its intent was to not limit publication so specifically.

The court also rejected Mt. Hood’s argument that the contents of one’s music library is not personal, such that its release to others qualifies as an “invasion of privacy.” The court looked at this issue closely. The opinion suggests that this may in fact be the case in some situations, but not here. Given that being a “tough guy” was such a significant part of Billingsley’s identity, knowledge by others that he had huge collections of music by Barry Manilow, Neil Diamond, Abba and the Carpenters was sufficient to qualify as an invasion of privacy.

The decision is a Beautiful Noise for Oscines and Song Sung Blue for Mt. Hood.

Let’s end it with this:

I’m on the top of the world looking down on creation

And the only explanation I can find

Is the love that I’ve found ever since you’ve been around

Your love’s put me at the top of the world

Good luck getting that out of your head before Thursday. Sorry. |

| |

That’s my time. I’m Randy Spencer. Contact Randy Spencer at

Randy.Spencer@coverageopinions.info |

| |

|

| |

|

|

|

|

Vol. 6 - Issue 4

April 12, 2017

|

|

|

|

|

|

|

|

| |

No matter how much experience a person has drafting Reservation of Rights letters, it is still easy to omit something. There is no set way to draft them and courts have been penalizing insurers for issuing Reservation of Rights letters that they do not believe are adequate. And this penalty can be severe -- the loss of coverage defenses. Look no further than January’s blockbuster decision from the South Carolina Supreme Court in Harleysville Group Insurance v. Heritage Group Communities.

Please join me on May 18th for the webinar:

“The Definitive Reservation of Rights Checklist: 50 Things That Every ROR Needs”

50 things that every ROR needs sounds like a lot. But I can make the case that there are that many things that every ROR should have -- or consider.

This Is The Most Practical Webinar That Someone Will Ever Attend. Most webinars involve esoteric discussion of case law. This court said this… This court said that… All this is forgotten five minutes after the webinar is over. Here, lawyers and adjusters will leave with a 50-item ROR checklist that they can begin to implement, in their actual work, 5 minutes after the webinar is over.

I am also pleased that the webinar is approved for CLE and adjuster CE in various states. Too many programs are approved for CLE for lawyers but not adjuster CE. Getting CE approval was a must-have for me in the arrangement.

I hope you’ll check out the program.

Details here:

https://www.eiseverywhere.com/ehome/239695 |

| |

|

| |

|

|

| |

|

|

|

|

Vol. 6, Iss. 4

April 12, 2017

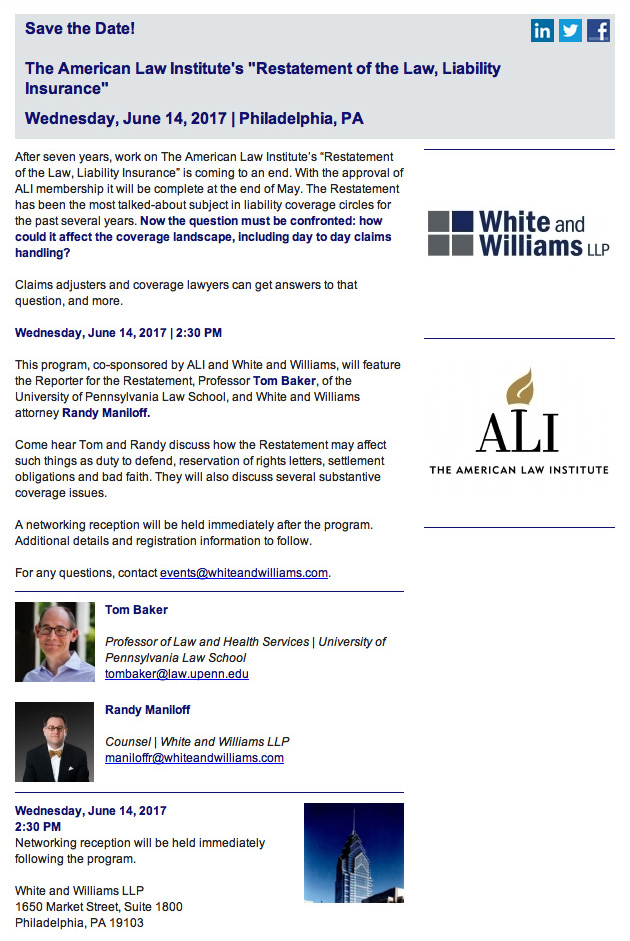

The ALI “Restatement of Liability Insurance” Is Almost Here

Free Seminar: What You Need To Know. How Might It Affect Claims Handling?

|

|

|

|

|

|

|

|

|

Vol. 6, Iss. 4

April 12, 2017

Farmers Insurance Hall Of Claims

A Don’t Miss For Those Who Like Interesting Insurance Claims

|

|

|

|

There’s nothing I like more than Jujubes and an interesting insurance claim. Those who read Coverage Opinions know the latter. My dentist knows the former.

Farmers Insurance also likes interesting insurance claims. You’ve seen their commercials. A dramatization of an unusual claim that Farmers paid, narrated by a nerdy professor, in a tweed jacket, pointing to it as proof that Farmers knows a thing or two because it’s seen a thing or two. Some of the claim depictions involve a dog that turns on a kitchen faucet and transforms the living room into a swimming pool (and then several dogs perform synchronized swimming), ice fishing gone awry when a large pick-up truck breaks through a frozen lake and a dog, in an effort to grab a slice of pizza out of the box on a stove top, turns on a burner, ignites the box and causes a fire.

I think the Farmers guy campaign really gets it. Insurance is perceived as a serious and sophisticated product. Hence, the professor to make that point. But insurance is also perceived as deadly dull (present company excluded of course). Farmers counters this hurdle with humorous reminders that we need to protect ourselves against life’s infinite potential mishaps, many of which could have never been imagined.

The Farmers guy actually has a name. He’s not just the Farmers guy. He is Prof. Nathaniel Burke, portrayed by Academy Award Winning Actor J.K. Simmons, for his role as the relentless music teacher in Whiplash. [My mom has been telling me for a while that I need to see that movie.] Simmons also has numerous television credits, including Oz, Law & Order and The Closer.

It’s interesting how two insurers approach the use of characters to brand their products. Farmers goes the nerd route. GEICO takes the exact opposite approach. The Gecko is the Fonz of insurance.

While some of Farmers’s interesting insurance claims are depicted in its commercials, there are many more where those came from. But you have to know where to look. The Farmers website includes the Farmers Insurance Hall of Claims. Here Farmers describes and illustrates more interesting and bizarre claims -- all just as much so as the ones featured in its commercials. There’s the moose that got tangled up in a back yard swing set, the hot water heater that exploded through a roof and the bear that helped itself to a steak in a Farmers’s customers freezer in his garage.

If you like interesting insurance claims, you will really enjoy visiting the Farmers Hall of Claims. You’ll find it on the Famers homepage.

[By the way, Farmers is not a client of mine and I am not a Farmers customer.]

|

|

|

|

| |

Vol. 6, Iss. 4

April 12, 2017 |

| |

|

|

|

Richard J. Petre Jr.:

Practicing Insurance Coverage Law In Louisiana

Louisiana law is unique. In general, it is much more influenced by codes than other states. It’s that whole Napoleon, French thing. I would say more about this – except I don’t know any more. Louisiana coverage law also differs significantly from just about every other state. Louisiana is referred to as a “direct action” state, which allows for an injured party to bring a claim directly against a tortfeasor’s insurer. Attempts by injured parties, in other states, to do this are routinely rejected. . |

|

|

|

| |

While it’s easy to say that Louisiana is a direct action state, and to define it, how does it actually work in practice? That’s the real issue. I suspect that many coverage lawyers, outside the Pelican State, don’t fully appreciate the nuts and bolts of it. There’s certainly more that I could learn. For this explanation, and what else is important about Louisiana liability coverage law, I turned to Richard Petre, Jr. of Onebane Law Firm in Lafayette, Louisiana.

Good choice on my part. Richard is the author of Louisiana Liability & Property Coverage Law: A Handbook for the Busy Practitioner (3d ed.). Richard is in his 40th year of practice and has handled over one hundred jury trials. His practice includes insurance coverage, insurer bad faith, personal injury, civil rights, arson, and construction litigation. He’s even handled capital cases as both a prosecutor and defense counsel

|

***

Louisiana has a reputation for being a challenging jurisdiction for liability and property insurers, but the Louisiana Civil Code, with its different nomenclature (predial servitudes, immovable and movable property) and its stated emphasis on legislation and custom as authoritative sources of law, is not the reason.

Yes, Louisiana does have a direct action statute. Under that statute, La. R.S. 22:1269, an injured claimant can sue directly liability insurers. The plaintiff must also sue the tortfeasor insured, unless the insured is involved in bankruptcy proceedings or has been adjudged bankrupt, is insolvent, cannot be served, or is a parent or spouse of the plaintiff. Unless there are coverage issues involved, juries do not get to see the policy or learn what the policy limits are, but they obviously know that the insured defendant has insurance coverage.

In cases involving more than one liability insurer, plaintiffs’ lawyers, after filing suit, have made at times a “Gasquet settlement,” where plaintiff settles with one liability insurer; the plaintiff agrees not to execute any excess judgment against the insured, who remains in the lawsuit as a nominal defendant; and the plaintiff reserves his rights against all other liability insurers.

And some cases have allowed the plaintiff, after filing suit, to actually dismiss the insured and still maintain suit against the liability insurer. Those courts have found that the direct action statute requires only that the insured be initially sued, not that suit against the insured be maintained. Soileau v. True Value, 144 So.3d 771 (La. 2013). Further, some Louisiana courts have rejected the insurer’s argument that, because the policy only covers damages that its insured becomes “legally obligated to pay,” the insured’s release should also result in dismissal of the insurer.

Louisiana courts readily find an “occurrence” under liability policies, stating that whether an accident occurred must be determined from the claimant’s point of view. In construction defect and intentional act cases, Louisiana courts will find an occurrence.

With construction cases, our Supreme Court, reversing a line of court of appeal cases, has found that the work product exclusions in CGL policies are not ambiguous. Supreme Services v. Sonny Greer, Inc., 958 So.2d 634 (La. 2007).

To determine when property damage occurs, Louisiana courts typically use the manifestation test, though it has been noted that our courts have “not uniformly adopted” the manifestation theory. Mangerchine v. Reaves, 63 So.3d 1049, 1058 (La. App. 1 Cir. 2011). In long-term environmental cases involving property damage and in continuous-exposure cases involving bodily injury, Louisiana courts have generally used the exposure test. Grefer v. Travelers Ins. Co., 919 So.2d 758 (La. App. 5 Cir. 2005); Cole v. Celotex Corp., 599 So.2d 1058 (La. 1992). In repeated-exposure cases, the number of victims may determine the number of occurrences under the policy. Lombard v. Sewerage and Water Bd., 284 So.2d 905 (La. 1973).

The Louisiana Supreme Court has largely limited the scope of the pollution exclusion, finding that the exclusion should apply only to industrial polluters or to true environmental damages. Doerr v. Mobil Oil Corp., 774 So.2d 119 (La. 2000).

With automobile insurance, the minimum liability limits are $15,000 per person and $30,000 per accident for bodily injury, and $25,000 for property damage. La. R.S. 32:900(B). And Louisiana has a “no pay, no play” law where the owner or operator of a motor vehicle who fails to have at least the minimum compulsory insurance limits cannot recover the first $15,000 of bodily injury damages and the first $25,000 of property damage. La. R.S. 32:866. But the statute contains a number of exceptions.

With the duty to defend, Louisiana courts thus far have strictly applied the “eight corners test,” and have not looked to evidence outside the pleadings. An insurer failing to provide a defense does not waive its coverage defenses. Arceneaux v. Amstar Corp., 66 So.3d 438 (La. 2011). But an insurer, which has knowledge of facts indicating noncoverage, and assumes the defense of an insured without obtaining a nonwaiver agreement, waives all coverage defenses then known to the insurer. Steptore v. Masco Const. Co., 643 So.2d 1213 (La. 1994).

And in a long latency occupational-disease case, the Louisiana Supreme Court has adopted the pro-rata allocation method, holding that defense costs should be prorated among insurers (based on their time on the risk during the exposure period) and the insured (based on the time during the exposure period when the insurer did not have insurance coverage). Arceneaux v. Amstar Corp., 200 So.3d 277 (La. 2016). The Court rejected the joint and several allocation method where the insurers pay all defense costs. The Court did not address whether the pro-rata allocation method will be used in long-term property damage cases.

In a major 2015 decision, the Louisiana Supreme Court found that a liability insurer can breach its duty to settle even though it did not receive a firm settlement demand. Kelly v. State Farm Fire & Casualty Company, 169 So.3d 328 (La. 2015). When liability is clear and damages readily exceed the policy limit, an insurer will be found in bad faith if it refuses to pay legal interest as well as its policy limit. Hodge v. American Fidelity Ins. Co., 486 So.2d 233 (La. App. 3 Cir. 1986).

La. R.S. 22:1973 in subsection (A) imposes a general “duty of good faith and fair dealing” on insurers, and in subsection (B) imposes six specific duties on insurers that, if knowingly done, breach the statute’s duty of good faith. Until Kelly v. State Farm Casualty Company, 169 So.3d 328 (La. 2015), the consensus in Louisiana was that the enumerated acts in subsection (B) were not illustrative, but constituted an exclusive list of the types of conduct that could violate this statute. However, in Kelly, the Louisiana Supreme Court found that, under the general duty language in subsection (A), an insured could bring a claim against his insurer for breach of the duty to settle, even though that duty was not enumerated in subsection (B). Under R.S. 22:1973, insurers have to pay the settlement proceeds within 30 days of a written settlement agreement, and insurers have to pay insureds within 60 days of receipt of satisfactory proof of loss (under R.S. 22:1892, the time period is 30 days). And under the 1973 statute, the claimant can recover those damages actually caused by breach of the duty and a penalty of two times the amount of those damages; or a penalty of up to $5,000, even if the insurer's breach of a duty did not cause damages. It should be noted that Louisiana does not authorize punitive damages for insurer bad faith.

Finally, Louisiana does not like jury trials as much as some other states: To the consternation of automobile insurers, a plaintiff pleading a cause of action in excess of $50,000 is needed for a jury trial. And Louisiana elects its judges—all of them. |

|

| |

|

|

Vol. 6, Iss. 4

April 12, 2017

Must Read: Insurer Sends Claims File, Using Non-Password Protected Link, Waives Attorney-Client Privilege

Court Harsh On Insurer’s Lack Of Precautions Taken

|

|

|

|

Harleysville Insurance Company v. Holding Funeral Home, No. 15-57 (D. Va. Feb. 9, 2017) is as cautionary of a claims handling tale for insurers as you’ll ever see. Lists of claims handling don’ts have been around for a long time and are many. But this one is new to the scene and has the potential to rise in frequency. The tale goes like this. In the court’s own words…

The teaser: “In essence, Harleysville has conceded that its actions were the cyber world equivalent of leaving its claims file on a bench in the public square and telling its counsel where they could find it. It is hard to image an act that would be more contrary to protecting the confidentiality of information than to post that information to the world wide web.”

Background: Harleysville and Holding Funeral Home were involved in coverage litigation concerning a fire. Thomas Cesario, a Senior Investigator for Nationwide (parent of Harleysville) “uploaded video surveillance footage of the fire loss scene, onto an internet-based electronic file sharing service operated by Box, Inc. Cesario then sent an email containing a hyperlink to the Box, Inc., internet site, by which Wes Rowe of the National Insurance Crime Bureau (“NICB”), could access the file containing the Video using the internet and download the Video. The Video was placed on the Box Site, and the hyperlink to the Box Site sent by email to Rowe on September 22, 2015.”

The problem starts: “Cesario placed files containing Harleysville’s entire claims file and Nationwide’s entire investigation file for the defendants’ fire loss, on the Box Site to be accessed by Harleysville’s counsel. Cesario then sent an email to Harleysville’s counsel with the same hyperlink he sent to Rowe to be used by counsel to access the Box Site and retrieve a copy of the Claims File.”

The train goes off the tracks: The insured’s “counsel issued a Subpoena Duces Tecum, dated May 24, 2016, to NICB requesting NICB’s entire file related to the fire. On or about June 23, 2016, NICB sent [the insured’s] counsel electronic copies of all documents and information it had received from Harleysville, including a copy of the September 22, 2015, email from Cesario to Rowe containing the hyperlink to the Box Site. That same day, [the insured’s] counsel, without the knowledge or permission of Harleysville or its counsel, used the hyperlink to gain access to the Box Site, which now contained the Claims File. [The insured’s] counsel downloaded the Claims File and reviewed it without ever notifying Harleysville’s counsel that they had accessed and reviewed potentially privileged information.” (emphasis added).

The Conflict: “Harleysville’s counsel argues that [the insured’s] counsel’s access to Harleysville’s Claims File was an improper, unauthorized access to privileged information requiring the disqualification of all [insured] counsel of record. [The insured’s] counsel argue[d] that the Motion should be denied because Harleysville waived any claim of privilege or confidentiality by placing the information on the Box, Inc., site where it could be accessed by anyone.”

T-H-E E-N-D: Putting aside the court’s discussion of the ins and outs of what it takes to waive attorney-client privilege under Virginia state law, the court held that Harleysville did. Such waiver was found on the basis of an inadvertent disclosure. In making this decision, the court looked to the reasonableness of the precautions taken to prevent the disclosure. And here the court was not sympathetic to Harleysville.

“With regard to the reasonableness of the precautions taken to prevent the disclosure, the court has no evidence before it that any precautions were taken to prevent this disclosure. The employee who uploaded Harleysville’s Claims File to the Box Site had used the site previously to share information with a third-party, the NICB. It does not matter whether this employee believed that this site would function for only a short period of time or that the information uploaded to the site would be accessible for only a short period of time. Because of his previous use of the Box Site, this employee either knew — or should have known — that the information uploaded to the site was not protected in any way and could be accessed by anyone who simply clicked on the hyperlink.” (emphasis in original”).

The moral: “The technology involved in information sharing is rapidly evolving. Whether a company chooses to use a new technology is a decision within that company’s control. If it chooses to use a new technology, however, it should be responsible for ensuring that its employees and agents understand how the technology works, and, more importantly, whether the technology allows unwanted access by others to its confidential information.”

[There is more to the story – waiver under federal law and the manner in which the insured’s counsel acted upon receipt of the claims file -- but that’s not relevant to share the cautionary tale.]

|

|

|

|

|

Vol. 6, Iss. 4

April 12, 2017

Case Of First Impression: Named Insured Must Satisfy SIR Before AI Gets Coverage

|

|

|

|

In Walsh Construction Company v. Zurich American Ins. Co., No. 45A04-1606-PL-1284 (Ind. Ct. App. Mar. 28, 2017) the Court of Appeals of Indiana held: “As a matter of first impression, we hold that a self insured retention endorsement to a commercial general liability insurance policy requires the named insured to satisfy the amount of the endorsement, whether on its own behalf or on behalf of an additional insured, before the additional insured may seek to enforce the policy against the insurer.”

On the point about first impression, the court noted that it was for Indiana, but also commented that none of the foreign authorities cited by the parties was on all fours.

Normally I make a big deal about cases of first impression and discuss them in detail. They are the types of cases that CO is all about. But I just don’t have time here. Lots going on and the publishing deadline for this issue is at hand. So I limit this article (if you can even call it that) to the court’s holding. Sorry. Although, it’s not like you’re paying for this.

I guess the moral of the story is that general contractors must police the policies that they require their subcontractors to obtain. This isn’t the first time that an additional insured obtained a policy that disappointed the general contractor’s expectations.

|

|

|

|

|

Vol. 6, Iss. 4

April 12, 2017

A Rarity: Bar Owner-Insured Gets Around An Expansive A&B Exclusion For A Shooting

|

|

|

|

There are oodles of coverage decisions involving the applicability of assault and battery exclusions – both in general liability and liquor liability policies. Insurers win many of these cases. That’s because assault and battery exclusions are usually written quite broadly – applying to both the assault and battery itself as well as the insured’s failures, in many ways, to prevent the assault and battery.

I don’t report on assault and battery coverage cases here too often because they are usually dog bites man stories. But Certain Underwriters at Lloyd’s London v. Butler, No. 16-975 (D.S.C. Feb. 13, 2017) is worth a note because the court concluded, at least for duty to defend purposes, that the assault and battery exclusion did not preclude coverage for claims brought by the victim of a bar shooting. This story almost always has a different ending.

Shakila Green was a guest at Round Two, a night club operated by Sarah and Willie Butler, when she was shot in both legs. Green filed suit against the Butlers, asserting a single cause of action for negligence. She alleged that the Butlers were negligent by “failing to properly secure the area by performing security checks for weapons as guests entered the business, failing to properly check the identification of guests, and failing to maintain proper control of the area.”

Lloyd’s, which issued a general liability policy to the Butlers, brought an action seeking a declaration that it had no obligation to defend or indemnify the Butlers for the Green action. The Lloyd’s policy issued to the Butlers contained an expansive assault and battery exclusion. It excluded assault and battery and every other conceivable way that could be related to assault and battery – failure to prevent assault and battery, negligent hiring, negligent training, failure to provide proper security and it need not matter who caused the assault and battery, where it took place or what anyone’s intent was. It’s an absolute, total, positive, no way, no how, we’re providing coverage for assault and battery, exclusion.

These expansive A&B exclusions almost always carry the day for insurers. But not here. The reason was simple. The court acknowledged that the exclusion provided six ways from Sunday why assault and battery was excluded. However, to trigger a defense, under the South Carolina standard, the complaint needed only to allege a “possibility” of coverage under the policy. The Green complaint, by being devoid of allegations about circumstances of the shooting, left open the possibility that Shakila’s injuries did not arise from an assault and battery.

The court explained its decision this way: “The only allegation in her complaint regarding the circumstances of the shooting do not suggest that the weapon’s discharge was intentional in any way. In its entirety, the only sentence describing the incident is as follows: ‘On or about the 11th day of August 2013, the Plaintiff, a minor at the time, was a guest at the adult business of the Defendants when she [was] shot in both of her legs, causing permanent damage.’ Nothing in this sentence suggests that the weapon was discharged during, or in relation to, a dispute or that it was discharged with some form of intent to cause bodily injury or to place another in apprehension of bodily injury. Instead, the sentence is consistent with an allegation that the weapon was discharged unintentionally or by accident.”

The moral of the story for plaintiffs’ attorneys is simple. If the duty to defend standard is that the complaint need only allege a “possibility” of coverage [which is a common standard], then the fewer the factual details alleged in the complaint the better. Of course, plaintiffs’ attorneys, when representing a person injured in a bar fight, often-times can’t resist drafting a windy complaint that reads like a scene out of Road House. By doing so, they are pleading right into an expansive assault and battery exclusion.

|

|

|

|

|

Vol. 6, Iss. 4

April 12, 2017

Appeals Court Says That State Farm’s “Like a Good Neighbor” Slogan Is Not A Material Fact

|

|

|

|

Back in the April 1, 2014 issue of Coverage Opinions I discussed Broadway v. State Farm, a March 2014 Alabama federal court decision where the court was, to say the least, woefully unimpressed with the insured’s efforts, stating: “If arguments had feelings, this one would be embarrassed to be here.” Ouch. The Eleventh Circuit just weighed in on the matter.

Joe Broadway [man what a cool name] attempted to bring a fraud claim against State Farm on the basis that the company advertises itself to its customers and potential customers as a “Good Neighbor.” Broadway Joe asserted that State Farm’s advertising slogan, “Like a good neighbor, State Farm is there,” induced him to purchase an auto insurance policy through State Farm. He alleged that the Good Neighbor slogan was a representation that State Farm treats its customers with respect to their insurance claims on a fair, reasonable and good faith basis. This, he alleged, did not happen with respect to State Farm not paying the limit of his UIM benefit.

The court was not persuaded, holding: “The Court need go no further in its analysis of Broadway’s fraud claim because he can prove no set of facts in support of his claim that State Farm’s ‘Good Neighbor’ slogan is anything other than mere opinion or puffery, and, hence, not a statement of material fact.” In reaching this conclusion, the court cited to the Connecticut federal court’s 2010 decision in Loubier v. Allstate Ins. Co., where the court held that “any fraud claim premised on Allstate’s ‘good hands’ advertising slogan must be dismissed.”

The Eleventh Circuit just affirmed, stating that the slogan “like a good neighbor, State Farm is there” is not a “representation of a material fact” and “constitutes nothing more than a statement of opinion or ‘puffery.’” Thus, in the absence of a misrepresentation of material fact, the insured failed to state a claim for fraud under Alabama law. Broadway v. State Farm, No. 16-13363 (11th Cir. Mar. 29, 2017).

Not a total loss. At least the appeals court did not say that the argument should be embarrassed.

|

|

|

|

|

Vol. 6, Iss. 4

April 12, 2017

Editorial: Number Of Occurrences: Is It Time For A Change?

|

|

|

|

The number of decisions, addressing “number of occurrences,” under a general liability policy, are staggering. In the past month or so alone there were at least five and they addressed a multitude of scenarios: injuries and damages caused by fireworks, defective windows, sexual abuse, tabletop torches and construction defects.

What makes the situation particularly interesting is that most states have adopted a test for determining if multiple injuries or damages were caused by one occurrence or multiple – usually the “cause” test or the “effect” test (or something along those lines). Under the “cause” test, number of occurrences is determined by examining the cause or causes of the damage. Under the “effect” test, number of occurrences is determined by examining the effect that an event had, i.e., how many individual claims or injuries resulted from it. The “cause” test is the majority rule nationwide.

That so much litigation takes place, to determine number of occurrences, even after the appropriate test has been established, can likely be explained by a combination of the tests being imprecise and the claims being fact-driven.

The significance of number of occurrences can be monumental. It can double, triple or more, the limits of liability at issue. Should an issue this significant, and that arises with such frequency, be subject to so much uncertainty?

The policy language that drives number of occurrences is this. Most commercial general liability policy’s Limits of Liability section state that the policy’s Each Occurrence Limit is the most that the insurer will pay for the sum of damages because of all “bodily injury” and “property damage” arising out of any one “occurrence.” Then, most policies define “occurrence” as “an accident, including continuous or repeated exposure to substantially the same general harmful conditions.”

This isn’t much and it’s general. Is it time for insurers to revisit their policy language to add further explanation of how to count occurrences, thereby possibly reducing litigation over the issue?

For example, claims made policies have a similar issue – number of claims. These policies often define the term “claim” in an effort to address the issue. For example, “Two or more ‘claims’ for, arising out of, in consequence of, in connection with or in any way involving or resulting from a single ‘wrongful act’ or series of related ‘wrongful acts’ shall be a single ‘claim.’ A series of related ‘wrongful acts’ are those that arise out of, are based on, relate to or are in consequence of the same facts, circumstances or situations.” Having said that, there is still plenty of litigation over the number of claims issue.

I’m not advocating one way or another whether insurers should add further language addressing number of occurrences. I haven’t studied the issue enough to have reached a conclusion. But I wonder about it when I see the frequent number of occurrences decisions, with so many having significant consequences.

|

|

|

|

|

Vol. 6, Iss. 4

April 12, 2017

Auto Exclusion Precludes Dram Shop Claim (Really)

|

|

|

|

When the insurance industry amended the “sudden and accidental” pollution exclusion to the “total” pollution exclusion it did not have the intended effect in every state. In many states, the total pollution exclusion, despite the name, was not upheld by courts to apply to all hazardous substances. Rather, it was limited to so-called traditional environmental pollution.

The “total” auto exclusion has not suffered the same fate. Here the auto exclusion, in a typical commercial general liability policy, is amended by eliminating the requirement that the auto be owned or operated by or rented or loaned to any insured. In general, courts have given “total” auto exclusions their expansive meaning. Nautilus Insurance Company v. 93 Lounge, No. 14-1029 (E.D.N.Y. Mar. 31, 2017) provides a good example of this.

At issue in 93 Lounge was coverage for, among other things, a suit filed by Ashley and Vanessa Encalada, alleging that they were injured on January 1, 2013, while walking along 93rd street in Kings County, New York when they were struck by a motor vehicle owned by Eileen Hughes and operated by Charles Amado. The Encaladas alleged that the accident was caused by the negligent operation of the motor vehicle. “The Encaladas also allege that, prior to the accident, Mr. Amado was a patron at 93 Lounge and Mr. Amado was sold, served and consumed alcoholic beverages while he was intoxicated at 93 Lounge, and therefore, 93 Lounge contributed to Mr. Amado's intoxication.”

Nautilus undertook 93 Lounge’s defense, against the Encalada suit, under a commercial general liability policy, subject to a reservation of rights. Nautilus cited the Liquor Liability exclusion and Auto exclusion.

The Nautilus general liability policy was amended to contain the following Auto exclusion, which is a total Auto exclusion; i.e., it eliminates the requirement that the auto be owned or operated by or rented or loaned to any insured: “‘Bodily injury’ or ‘property damage’ arising out of the ownership, maintenance, use or entrustment to others of any aircraft, ‘auto’ or watercraft. Use includes operation and ‘loading or unloading’. This exclusion applies even if the claims allege negligence or other wrongdoing in the supervision, hiring, employment, training or monitoring of others, if the ‘occurrence’ which caused the ‘bodily injury’ or ‘property damage’ involved the ownership, maintenance, use or entrustment to others of any aircraft, ‘auto’ or watercraft. This exclusion does not apply to: . . .”

Nautilus filed an action against 93 Lounge seeking a declaration that it had no duty to defend or indemnify it for the Encalada action. Nautilus filed a motion for summary judgment. The court held that the Liquor Liability exclusion and Auto exclusion both served to preclude coverage.

Looking at the Auto exclusion, the court concluded that it “clearly and unambiguously exclude[d] coverage for any and all personal injuries ‘arising out of the . . . use . . . of any . . . auto[mobile],’ including use by third parties, and that an ordinary businessperson could not have reasonably believed otherwise.” The court made the important observation that “[n]othing in the language of the exclusion indicates that the exclusion was limited to only the insureds and others with a formal relationships with the insured.” In other words, the Auto exclusion applied for one reason -- it was amended to eliminate the requirement that the auto be owned or operated by or rented or loaned to any insured.

|

|

|

|

|

Vol. 6, Iss. 4

April 12, 2017

Clever (But Not Clever Enough) Argument To Avoid The Business Pursuits Exclusion

|

|

|

|

Cases involving the potential applicability of the “Business Pursuits” exclusion, under the liability section of a homeowner’s policy, are often interesting. That’s because people run all sorts of businesses out of their homes -- and all sorts of mishaps can occur.

One common home-based business claim involves insureds seeking coverage for situations – often tragic – arising out of their operation of day cares for children. In general, when the insured receives compensation for providing day care serves, coverage is often denied on the basis that the operation is an excluded business pursuit.

This was the situation in Vermont Mutual Insurance Co. v. Hebert, No. 16-34 (D. Conn. Mar. 20, 2017), but with a couple of twists. Debra Samson operated a home day care. Matthew Hebert, while picking up his child from the day care, was bitten by Ms. Samson’s dog. Mr. Hebert filed suit and Ms. Samson defaulted. The court awarded Mr. Hebert $125,000 at a damages hearing.

Litigation ensued between Mr. Hebert and Ms. Samson’s homeowner’s insurer. Ms. Samson’s homeowner’s policy contained a business pursuits exclusion. And the policy even went a step further, specifically stating that a home day care is a “business,” unless it is done for a relative or without receiving compensation or as a mutual exchange. Nobody disputed that Ms. Samson’s home day care qualified as a business.

So what was Mr. Hebert to do? It seems like he had a ruff road. He made the following argument: “[Hebert] counters that coverage is not excluded, because to be excluded an injury must arise out of a business’s ‘operative activity’—here, the care and supervision of children—and that a dog bite is incident to the non-business pursuit of owning and keeping a dog.”

It’s a clever argument, and probably the best Mr. Hebert could do in the face of a tough situation, but the court did not bite, noting that “[t]he Connecticut Court of Appeals has held that the policy language ‘arising out of the business pursuits . . . of an insured’ ‘establishes an expansive standard of causation between the incident giving rise to a claim for coverage and the insured’s business pursuits.’”

With that standard in play, turning to the matter at hand, the court didn’t really struggle to conclude that the business pursuits exclusion precluded coverage: “The ‘operative activity’ here is the care and supervision of children who are too young to transport themselves. As such the children’s parents were invited onto the premises to drop off and pick up their children and pay Ms. Sampson for her services. Because the parents of her charges entered the premises for a purpose directly related, indeed essential, to the care of her charges, she owed a duty to the children as well as their parents to maintain the premises in a reasonably safe condition, and not to keep an aggressive and violent dog on the premises.”

|

|

|

|

|

| |

|

|

Was This April Fool’s Three Days Early?

Here’s an interesting headline that appeared in Business Insurance online on March 29: “Disability Support Firm Settles ADA Lawsuit.” The article states: “A Phoenix disability support services company has agreed to pay $100,000 to settle a U.S. Equal Employment Opportunity Commission lawsuit that charged it with discriminating against disabled employees by refusing to provide them with reasonable accommodations, the agency said Tuesday. . . . The EEOC had said in its February 2015 lawsuit that [the company] violated the Americans with Disabilities Act by firing employees with disabilities rather than providing them with reasonable accommodations because of its inflexible leave policy.” The BI article also notes that the company “said in a statement it is denying the charges, but settled with the agency to avoid potentially much higher litigation costs.” [Thank you to a loyal CO reader for passing this along.]

Follow-Form Excess Insurer Need Not Follow Underlying’s Coverage Determination

In case you have this issue: “We agree with the rationales expressed in both In re Liquidation of Midland Ins. Co. and Allmerica and conclude that a follow form insurer is not automatically bound by the coverage determinations of the primary policy insurer. Although, as noted supra, Appellant cites a number of out-of-state cases for the premise that follow form policies should be construed in a manner consistent with the primary policy, we note that none of these cases require that the follow form insurer be bound by the primary insurer’s interpretation of the contract language. Instead, these cases stand for the principle that where a court interprets the policy language of the primary policy, it may not give the same language a different meaning as to the excess policy. (citation omitted). Therefore, we hold that XL was free to interpret the contract language contained in the Zurich Policy in a way that departed from Zurich’s interpretation of the same language under the circumstances presented.” Cristal United States v. XL Specialty Ins. Co., No. 2494 (Md. Ct. Spec. App. Feb. 24, 2017) (emphasis in original).

|

|

| |

|

|

|

| |

|

|

|

|

|

|

|

|

|